Compare the Best Home and Auto Quotes Online – Fast, Easy & Affordable

In today’s digital-first world, getting home and auto insurance quotes online is not just convenient—it’s smart.

Comparing policies through online tools allows you to quickly evaluate pricing, coverage, and bundled savings from top providers without making countless phone calls. This guide dives into everything you need to know about home and auto quotes online, including benefits, technology advantages, real-world examples, and how to buy with ease.

What Are Home and Auto Quotes Online?

Home and auto quotes online refer to insurance estimates you receive by inputting your information on an insurance company’s website or through a comparison platform. These quotes provide insight into how much you’ll pay for coverage and what that coverage includes.

Instead of visiting agents or waiting on calls, online quoting systems let you instantly view different policy combinations from various insurers. They also allow you to customize features and compare savings on bundling both home and auto policies.

Why You Should Use Online Platforms for Insurance Quotes

Instant Access and Price Comparison

One of the biggest benefits of online quotes is speed. Within minutes, you can enter your zip code, vehicle and home details, and receive side-by-side comparisons of rates and benefits. These systems pull live data from insurers to ensure pricing accuracy and availability.

This transparency empowers you to make smarter financial decisions and helps avoid overpaying for similar or lesser coverage.

Convenience and Control at Your Fingertips

Getting insurance quotes online gives you full control over the process. You can adjust deductibles, add extra coverage, or even simulate various “what if” scenarios—like adding a teen driver or upgrading your home’s security.

Everything happens on your time, with no pressure from sales reps. The 24/7 availability means you can compare quotes at midnight or during your lunch break—whatever works for you.

Top Providers Offering Online Home and Auto Quotes

Here are five top-rated providers that offer comprehensive home and auto insurance quotes online. Each one delivers unique technology, benefits, and savings potential.

Progressive offers a powerful online quoting system that lets you bundle and compare policies instantly

Their Name Your Price® tool allows users to choose a budget and receive policy options that match it.

Use Case: A busy professional needed coverage for a suburban home and a leased SUV. Using Progressive’s online system, they bundled policies in under 10 minutes and saved over $650 annually.

Benefits:

- Tailored price-matching feature

- 24/7 policy updates via app

- Snapshot® tool for driving discounts

Progressive’s technology provides real-time updates and coverage simulation, so you always know what you’re getting—and saving.

GEICO’s fast quote tool uses minimal input and delivers full quote results within minutes

It’s ideal for tech-savvy users who want immediate results.

Use Case: A digital nomad needed a policy that could be managed entirely from a mobile device. GEICO’s online portal and app allowed full customization and immediate binding of both policies.

Benefits:

- Mobile-first design

- Affordable pricing

- Simple coverage bundling

With GEICO, users enjoy a streamlined interface, automatic renewal reminders, and policy changes directly through their smartphone.

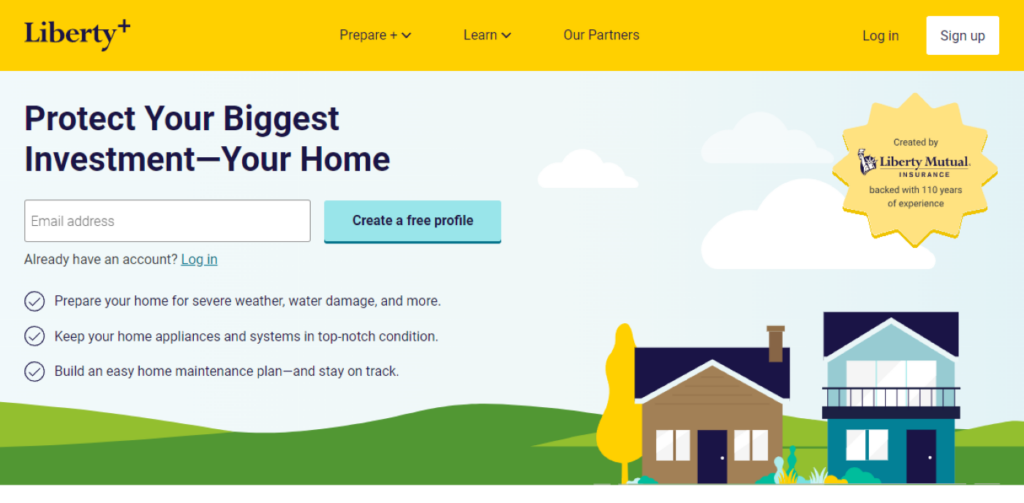

Liberty Mutual’s online quoting system is packed with smart features like coverage analyzers and bundled discount visibility

It’s especially great for users who want more in-depth comparison tools.

Use Case: A family moving to a new home used Liberty’s quote engine to bundle policies with theft protection and student driver coverage, saving over $800 annually.

Benefits:

- Enhanced customization tools

- Multi-car and multi-policy discounts

- Smart device integration for extra savings

Liberty Mutual’s technology provides smart home integration and suggests discounts based on your lifestyle.

Allstate’s Digital Locker® and quote engine make it easy to track your home inventory and tailor coverage needs in real time.

Use Case: A homeowner with expensive electronics and a sports car used Allstate’s tools to create an exact-fit bundle that offered premium protection without overpaying.

Benefits:

- Easy-to-use quote flow

- Real-time bundling calculations

- Enhanced home inventory tracking

Allstate gives policyholders peace of mind with digital documentation and on-demand support.

State Farm’s online quote platform is supported by local agents, allowing you to complete most of the process digitally and finalize with a trusted adviso

Use Case: A couple relocating across states used the online platform to generate a quote and finalize coverage with a nearby agent, saving time and ensuring state compliance.

Benefits:

- Local agent follow-up

- Fully digital quote comparison

- Multiple bundling tiers

State Farm blends digital speed with human support, perfect for those who value personalization.

Benefits of Using Online Quote Tools

Transparency and Fair Pricing

One of the strongest benefits of using online tools is that you see real prices without hidden fees. This transparency levels the playing field, helping customers avoid overpriced policies.

Quote tools also use predictive analytics to recommend coverage amounts based on your zip code, age, and asset profile, providing smarter estimates.

Seamless Bundling Capabilities

Online tools automatically calculate bundling savings and allow you to apply changes live. You can test how a different deductible or liability limit impacts pricing instantly. This empowers you to make financially sound decisions in real-time.

What Problems Do These Online Quote Tools Solve?

Getting insurance through traditional methods can be slow, frustrating, and inconsistent. These platforms solve that by offering:

- Faster turnaround: Get results in minutes, not days.

- Accurate comparisons: Easily see what each provider offers.

- Lower costs: Bundled discounts and usage-based pricing models.

- Improved planning: Predict your yearly costs before committing.

People need this service to reduce financial waste, save time, and make informed insurance decisions with confidence.

How to Get Online Quotes and Buy CoverageGetting started is simple and secure. Here’s how you can do it today:

Steps to Buy:

- Choose your preferred provider from the list above.

- Visit their website and enter your home and vehicle details.

- Customize your coverage.

- Compare bundled prices.

- Finalize and pay securely online.

Buy from these providers:

- <a href=”https://www.progressive.com/home-auto/” target=”_blank”><button>Get Quotes from Progressive</button></a>

- <a href=”https://www.geico.com/bundle/” target=”_blank”><button>Start with GEICO Online</button></a>

- <a href=”https://www.libertymutual.com/insurance/bundling” target=”_blank”><button>Get Liberty Mutual Bundle</button></a>

- <a href=”https://www.allstate.com/bundling” target=”_blank”><button>Quote with Allstate</button></a>

- <a href=”https://www.statefarm.com/insurance/bundles” target=”_blank”><button>Compare at State Farm</button></a>

FAQ

Q1: Are online quotes as accurate as agent-provided quotes?

Yes, online quotes pull real-time data from underwriters and use your input to provide highly accurate pricing and coverage options.

Q2: Can I still talk to an agent if I get a quote online?

Absolutely. Most providers offer a hybrid model where you start online and complete your purchase with an agent if needed.

Q3: Is it safe to enter my personal information for quotes online?

Yes. Reputable providers use encryption and secure servers to protect your data. Just make sure you’re on the official website.