Best Way to Shop Auto Insurance Rates in 2025: Compare, Save, and Switch Easily

How to Shop Auto Insurance Rates and Find the Best Deals in 2025

Auto insurance is a necessary part of owning a vehicle—but that doesn’t mean you have to pay a premium price. If you haven’t compared your policy in a while, you might be overpaying by hundreds each year. Shopping auto insurance rates is the smartest move a vehicle owner can make, especially in 2025 when technology and data personalization allow insurers to offer highly competitive, customized premiums.

In this guide, we’ll walk you through the process of shopping for auto insurance rates, the benefits of switching, and what real-world insurance products are worth your time and money.

Why Shopping Auto Insurance Rates Is Essential

There was a time when people stayed with the same insurance company for years. Today, that loyalty often comes at a cost. Auto insurance providers constantly update their pricing models, discounts, and product offerings. What was the best deal two years ago might not even be average today.

By actively comparing auto insurance rates:

- You ensure your policy reflects your current lifestyle, not outdated habits.

- You take advantage of new discounts, especially those driven by technology.

- You can choose policies with more flexible terms or better customer service.

- You avoid premium creep—where your rates rise annually without explanation.

Shopping around empowers you to be a smarter consumer and ensures that you’re always getting the coverage you need for the lowest possible cost.

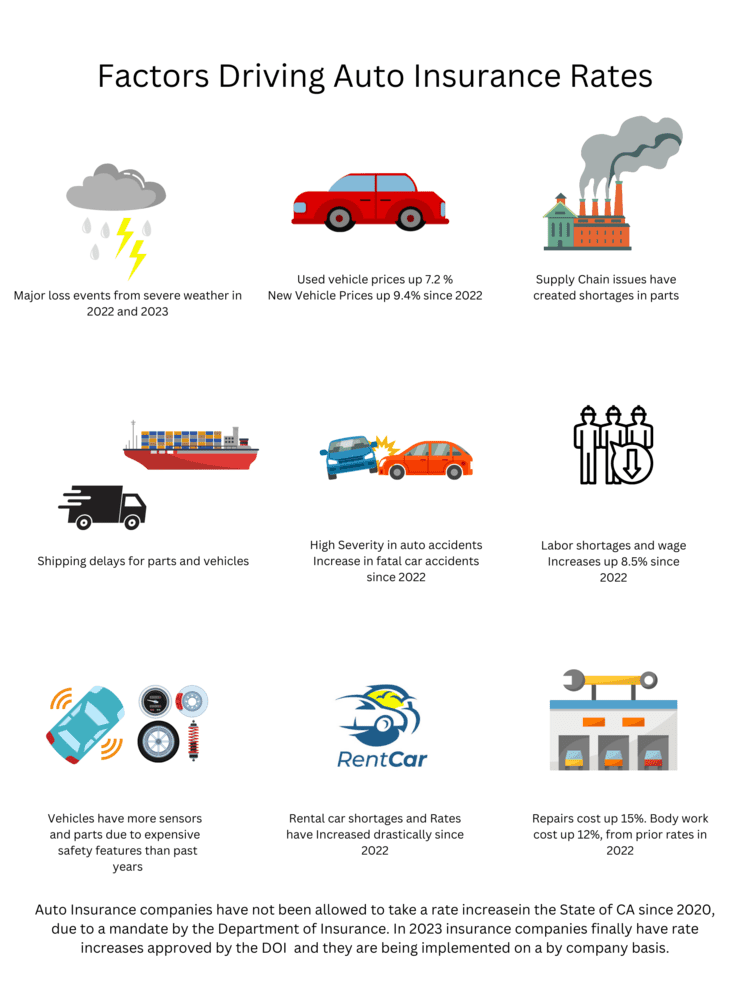

What Influences Auto Insurance Rates

When you start comparing quotes, you’ll notice that rates vary significantly between providers. Here’s why:

- Driving History: Clean records yield lower premiums.

- Vehicle Type: Some vehicles are more expensive to insure due to repair costs or theft rates.

- Zip Code: Urban areas usually come with higher rates due to higher accident risk.

- Mileage Driven: Lower mileage often qualifies you for lower rates.

- Credit Score: In most states, your credit affects your rate.

- Coverage Selections: Full coverage costs more than minimum liability.

- Technology-Based Discounts: Many insurers now offer savings for safe driving habits tracked via apps or plug-ins.

By understanding these variables, you can better tailor your shopping process and zero in on what’s affecting your current premium.

Benefits of Using Technology to Shop Auto Insurance Rates

In 2025, shopping for auto insurance doesn’t mean calling around or sitting through lengthy sales pitches. It’s a fast, tech-driven experience designed to help consumers make informed choices.

Digital Quoting Tools:

Modern platforms allow you to receive multiple quotes within minutes by entering your information once. These tools access real-time data from top providers to show you accurate comparisons without hassle.

Telematics and Usage-Based Insurance:

Companies now use telematics (driving behavior data) to offer personalized pricing. If you’re a safe driver, this can translate to major savings—often 20% to 40% lower than traditional rates.

Mobile Policy Management:

Apps and websites give you access to ID cards, claims processing, roadside assistance, and policy updates at your fingertips.

Consumer Reviews and Ratings:

Online platforms provide verified customer reviews, helping you assess service quality before purchasing.

These technological advancements not only make rate shopping easier—they also ensure that you’re always in control of your policy and premium.

Top 5 Auto Insurance Products to Compare in 2025

- <a href=”https://www.progressive.com” target=”_blank”>Progressive Auto Insurance</a> Progressive is a favorite among online shoppers for its Name Your Price tool, which tailors policy options to your budget. The Snapshot program allows you to earn discounts based on how you drive. Product Benefits:

- Personalized quotes with the Name Your Price featureReal-time driving feedback through the Snapshot appCompetitive discounts and bundling opportunities

A single driver commuting to work 15 miles daily can use Snapshot to earn safe-driving discounts and get a policy that reflects actual usage rather than general risk models.

- <a href=”https://www.geico.com” target=”_blank”>GEICO Auto Insurance</a> Known for low rates and a user-friendly online platform, GEICO offers one of the most seamless quoting processes. With various discounts and an award-winning mobile app, it’s ideal for digital-first consumers. Product Benefits:

- Military, federal, and good driver discountsEasy-to-use mobile app for all policy tasks24/7 customer service and roadside assistance

A tech-savvy millennial who prefers managing their insurance online can take advantage of GEICO’s automation and frequent discounts for safe drivers.

- <a href=”https://www.statefarm.com” target=”_blank”>State Farm Auto Insurance</a> State Farm’s Drive Safe & Save app is perfect for those looking to earn rewards through responsible driving. The local agent support combined with digital tools makes it a solid hybrid solution. Product Benefits:

- Up to 30% off for safe driving habitsPersonalized support from local agentsFlexible bundling for renters, home, and life insurance

A suburban family looking to insure multiple cars and possibly a home can benefit from the bundling and local service flexibility of State Farm.

- <a href=”https://www.libertymutual.com” target=”_blank”>Liberty Mutual Auto Insurance</a> Liberty Mutual offers highly customizable policies and unique features like better car replacement and accident forgiveness. Their app also supports photo-based claims filing. Product Benefits:

- Customizable policies including coverage for teachers and studentsRightTrack telematics app for safe-driving rewardsQuick, app-based claims and policy tools

A recent college graduate with a newer vehicle can use Liberty Mutual’s Better Car Replacement and RightTrack to lock in affordable, flexible coverage.

- <a href=”https://www.allstate.com” target=”_blank”>Allstate Auto Insurance</a> Allstate’s Drivewise and Milewise programs cater to both high-mileage commuters and low-mileage drivers. Cashback rewards and usage-based pricing make it an attractive, budget-conscious option. Product Benefits:

- Cashback for safe driving every six monthsPay-per-mile option for low-mileage driversAccident forgiveness and new car replacement

A retiree or part-time worker who drives infrequently can save more through the Milewise program, paying only for what they drive.

How Shopping Auto Insurance Rates Solves Real Problems

Many drivers encounter one or more of the following problems with their auto insurance:

- Skyrocketing Premiums: Rates increase yearly without an apparent reason.

- Lack of Personalization: Generic policies don’t reflect individual habits or needs.

- Poor Claims Service: Delays in claims processing create frustration.

- Outdated Discounts: Staying with one insurer means missing out on new deals.

By shopping rates, you solve these issues with policies that match your lifestyle, cost less, and offer better support.

How to Buy Auto Insurance Online

Buying auto insurance online is a straightforward process. Here’s how to do it right:

- Prepare Your Information

Have your driver’s license, vehicle registration, and current policy on hand. - Visit Trusted Comparison Platforms or Direct Providers

Use platforms like Policygenius or go directly to trusted insurers like GEICO, Progressive, or Liberty Mutual. - Compare Multiple Quotes

Look at cost, coverage levels, and extras like accident forgiveness, rental coverage, and roadside assistance. - Choose and Purchase

Pick the best deal, complete your application, and make your first payment. - Download the Mobile App

Use the insurer’s mobile app to manage your policy, file claims, and get roadside help.

Where to Buy:

- <a href=”https://www.progressive.com” target=”_blank”><button>Buy Progressive Insurance</button></a>

- <a href=”https://www.geico.com” target=”_blank”><button>Buy GEICO Insurance</button></a>

- <a href=”https://www.statefarm.com” target=”_blank”><button>Buy State Farm Insurance</button></a>

- <a href=”https://www.libertymutual.com” target=”_blank”><button>Buy Liberty Mutual Insurance</button></a>

- <a href=”https://www.allstate.com” target=”_blank”><button>Buy Allstate Insurance</button></a>

FAQ: Shopping Auto Insurance Rates

1. When is the best time to shop auto insurance rates?

The best time is before your policy renews, after a major life event (marriage, move, new vehicle), or if you’ve improved your credit score.

2. Will switching auto insurance affect my coverage?

No, as long as you avoid any gap between canceling the old policy and starting the new one, your coverage will continue seamlessly.

3. Is it safe to buy auto insurance online?

Yes, as long as you use reputable providers or trusted comparison platforms. Look for secure sites (https) and always read policy terms before purchase.

Would you like a downloadable version of this article or help writing another one for a related keyword like “auto and home insurance bundle rates”?