Avalara SAP Integration: Automate Global Tax Compliance in SAP Environments

Avalara’s integration with SAP systems provides a comprehensive tax automation solution designed for enterprises operating across multiple tax jurisdictions. By connecting Avalara’s powerful tax engine with SAP’s robust ERP platforms, businesses can streamline tax determination, calculation, exemption management, and filing—all in real time.

This integration is essential for businesses that manage high transaction volumes, operate internationally, or require audit-ready reporting. Whether using SAP ECC, S/4HANA, or SAP Business One, Avalara helps ensure compliance, minimize risk, and reduce operational overhead.

Understanding Avalara SAP Integration

Avalara SAP integration involves embedding Avalara’s AvaTax engine and related services into SAP systems to manage indirect taxes such as sales tax, VAT, and GST. This connection eliminates the need to manually update tax rates and rules, which can be complex and ever-changing, especially in cross-border transactions.

The integration supports real-time tax determination across all transactional documents within SAP. It handles sales orders, invoices, credit memos, and purchase transactions with complete transparency and compliance.

Key Benefits of Integrating Avalara with SAP

Real-Time Accuracy

Avalara ensures real-time access to the latest tax rules and jurisdiction boundaries. This real-time calculation improves invoice accuracy and reduces costly tax errors.

Enterprises avoid underpayments, overpayments, and missed exemptions. The automated process also supports scalability as tax jurisdictions evolve.

Streamlined Filing and Reporting

Avalara doesn’t stop at tax calculation. It automates tax returns, VAT filings, and remittances by extracting relevant data directly from SAP. Teams save hours previously spent on manual preparation.

The solution offers a centralized dashboard that provides visibility into liabilities across regions, due dates, and filing statuses.

Enhanced Compliance

Avalara stays current with international tax law changes, helping companies stay compliant with VAT, GST, and US Sales Tax regulations. Integration with SAP enforces tax consistency across all regions and entities.

This is especially important for companies subject to audits or operating in regulated industries like manufacturing, e-commerce, and digital services.

Avalara AvaTax for SAP ECC

Avalara AvaTax for SAP ECC provides native integration with SAP ECC to automate real-time tax calculations. It covers both domestic and international transactions.

AvaTax retrieves current tax rates and applies them dynamically to sales orders and billing documents in ECC. Businesses reduce errors, improve reporting accuracy, and streamline compliance workflows.

Use Case: A manufacturing company operating in multiple U.S. states uses AvaTax to accurately apply state-specific sales tax across invoices. The integration reduced audit fines and manual processing costs.

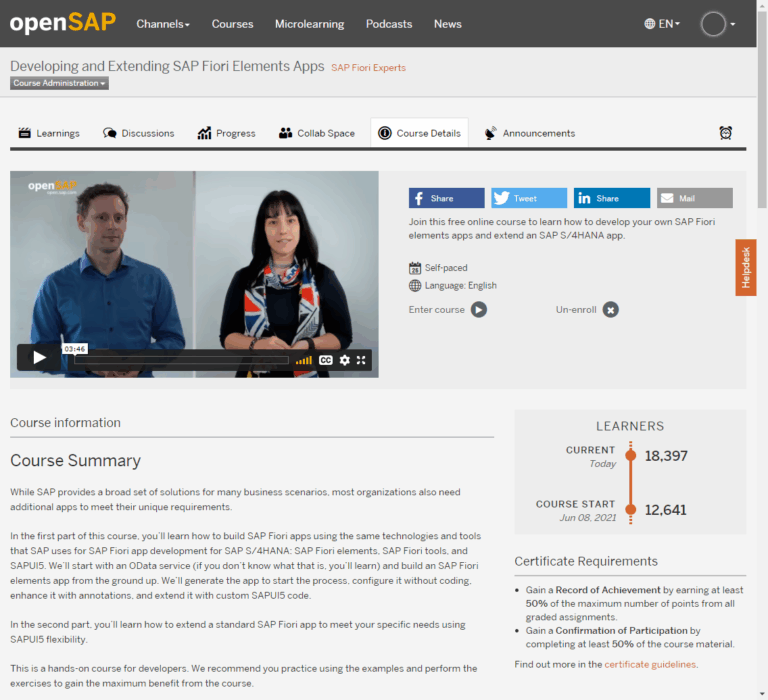

Avalara AvaTax for SAP S/4HANA

Avalara AvaTax for SAP S/4HANA supports real-time, automated tax determination for the latest generation of SAP ERP. It works across both public and private cloud versions of S/4HANA.

AvaTax integrates directly into the document flow within SAP, ensuring consistent tax treatment across financial and logistical operations. It also supports advanced scenarios such as intercompany billing and international VAT.

Use Case: A multinational retailer uses AvaTax for SAP S/4HANA to manage EU VAT and U.S. sales tax within a single ERP system. This significantly reduced complexity in cross-border operations.

Avalara for SAP Business One

Avalara for SAP Business One is designed for SMBs that need reliable tax automation. It connects SAP B1 with AvaTax to automate tax rates and compliance.

It calculates accurate sales tax on every invoice and purchase order and reduces manual data entry. Integration with Avalara Returns also automates monthly sales tax filings for small and mid-sized businesses.

Use Case: An online apparel store using SAP Business One leverages Avalara to manage tax obligations across multiple U.S. states. The solution ensured tax compliance during rapid growth.

Avalara CertCapture Integration

Avalara CertCapture integrates with SAP to manage sales tax exemption certificates. It validates and stores certificates in a secure portal, automating expiry tracking and audit preparation.

This solution eliminates the risk of invalid certificates and ensures proper exemption application at the point of sale.

Use Case: A wholesaler operating in multiple B2B markets uses CertCapture with SAP ECC to automate the collection and renewal of exemption documents.

Avalara Returns for SAP

Avalara Returns automates the preparation, filing, and remittance of tax returns by syncing directly with SAP transaction data.

It validates data, applies jurisdiction-specific rules, and submits returns to tax authorities. This reduces human error and increases compliance reliability.

Use Case: A SaaS company with operations in over 15 states uses Avalara Returns with SAP S/4HANA to automate monthly filings and reduce manual effort by over 80%.

Problems Solved by Avalara SAP Integration

Manual tax compliance is time-consuming and error-prone. Common challenges include:

- Incorrect tax rates

- Missing or expired exemption certificates

- Late or incorrect tax filings

- Limited visibility across jurisdictions

Avalara solves these by offering:

- Automated tax determination and filing

- Secure certificate management

- Real-time rule updates

- Complete visibility via dashboards and reports

With integration in SAP, these processes are embedded within business workflows, making tax compliance an invisible, seamless part of ERP operations.

How to Buy Avalara SAP Solutions

You can purchase Avalara SAP products directly through:

- Avalara Official Site

- SAP-certified resellers and implementation partners

Buy Now: 👉 Explore Avalara SAP Integrations

You can also request a demo or consultation tailored to your SAP setup. Avalara provides onboarding assistance and technical support throughout the integration process.

Frequently Asked Questions

1. What SAP platforms does Avalara support?

Avalara supports SAP ECC, SAP S/4HANA (cloud and on-premise), and SAP Business One.

2. Can Avalara handle international taxes?

Yes. Avalara automates VAT, GST, and sales tax for over 190 countries and jurisdictions.

3. Is the integration real-time?

Yes. Tax calculations and updates occur in real-time during transactions within SAP.