Best Car Insurance Companies to Shop in 2025 | Compare & Save Today

Shopping for car insurance has evolved beyond just comparing prices. Today, customers seek comprehensive coverage, digital tools, responsive customer service, and real-world value. In 2025, the leading car insurance companies are going above and beyond by leveraging cutting-edge technology and personalized plans. Let’s explore how you can shop smart, choose the right provider, and get the most value for your money.

Why Shopping for Car Insurance Companies Matters

Car insurance is not just a legal necessity—it’s a crucial financial protection tool. The right policy can save you thousands of dollars in the event of an accident, theft, or natural disaster. Shopping around gives you the power to:

- Compare pricing for similar coverage

- Discover better customer service experiences

- Evaluate digital tools and mobile apps

- Choose from flexible payment plans and discounts

What to Look for When Shopping for Car Insurance Companies

Coverage Options and Customization

Not all insurance policies are created equal. The best companies offer a range of customizable plans that allow you to build your policy around your specific needs. Whether you need comprehensive, collision, or liability coverage, having the flexibility to tailor your protection is essential.

Digital Tools and Mobile Access

In 2025, technology is transforming how customers interact with insurers. Look for companies that offer:

- User-friendly mobile apps

- Real-time policy management

- Claims tracking and submission via smartphone

- Telematics programs for usage-based insurance

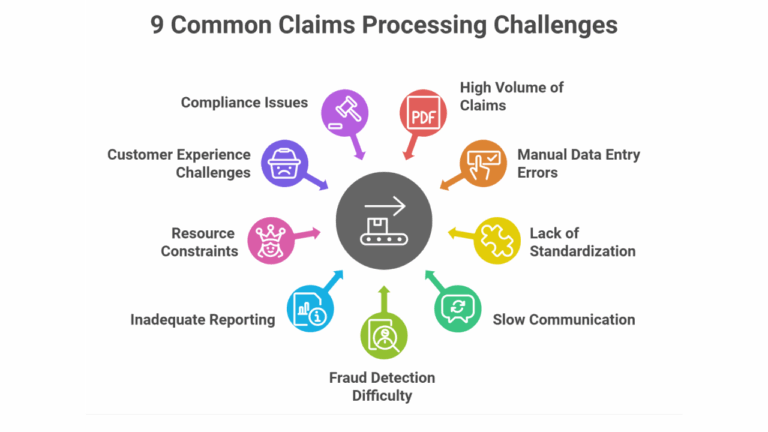

Customer Support and Claims Experience

Customer service can make or break your insurance experience. Top insurers provide 24/7 support, fast claims processing, and highly rated customer satisfaction scores.

Real-World Examples of Top Car Insurance Companies to Shop in 2025

GEICO Car Insurance

GEICO is known for its competitive rates and strong digital presence. Their mobile app offers easy claims processing, roadside assistance, and digital ID cards.

Use Case: Ideal for tech-savvy drivers looking for affordable, no-frills coverage with an intuitive app.

Benefit: GEICO uses telematics to offer discounts for safe driving habits, making it a cost-effective solution.

How to Buy: Visit their official website and get a free quote.

Progressive Car Insurance

Progressive offers a wide variety of discounts, n excellent mobile experience, and the Name Your Price® tool that helps you find a plan within your budget.

Use Case: Perfect for budget-conscious drivers who want flexible options and multiple discount opportunities.

Benefit: Snapshot® program uses real-time driving data to calculate personalized rates.

How to Buy: Start your quote online for instant options.

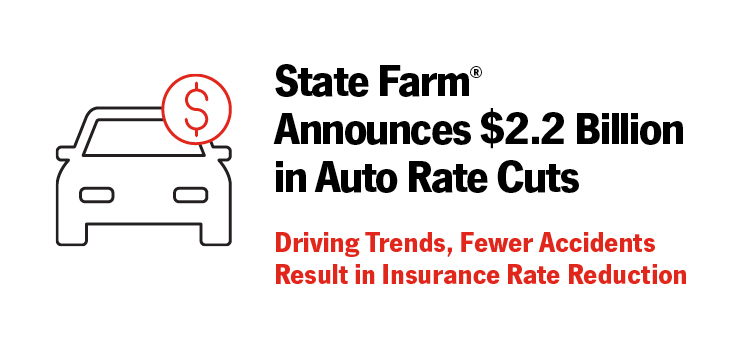

State Farm Car Insurance

State Farm is a great option for those who prefer local agents but still want mobile functionality. Their Drive Safe & Save™ program offers discounts for good driving habits.

Use Case: Great for families or individuals who value personal interaction and reliability.

Benefit: Exceptional customer service with a nationwide network of agents.

How to Buy: Contact a local agent or get a quote online.

Allstate Car Insurance

Allstate combines traditional insurance reliability with modern tools like their mobile app and Drivewise® program.

Use Case: Best for drivers who want a mix of hands-on support and mobile management.

Benefit: Offers accident forgiveness, safe driving bonuses, and extensive bundling options.

How to Buy: Online quote tool or visit an agent.

Liberty Mutual Car Insurance

Liberty Mutual provides fully customizable insurance policies and strong accident forgiveness options.

Use Case: Ideal for drivers with a specific set of coverage needs who value flexibility.

Benefit: Offers new car replacement and a unique deductible fund that lowers your deductible over time.

How to Buy: Customize and purchase your policy online.

Key Benefits of Using Top Car Insurance Companies

Personalized Pricing with Telematics

Modern insurers like Progressive and State Farm use telematics technology to assess driving behavior. This results in fair, personalized pricing that rewards safe drivers.

Fast and Easy Claims Process

Advanced mobile apps streamline claims processes. Submitting evidence, tracking status, and speaking with a representative has never been easier.

Bundling and Discounts

Bundling auto insurance with other policies (like home or renters) often unlocks significant savings. Most top companies provide multi-policy discounts.

Use Cases: Common Problems Solved by the Best Car Insurance Providers

Accident Protection

Car accidents can lead to thousands in repairs and medical bills. Having a reliable provider ensures quick claims and minimal out-of-pocket costs.

Theft and Vandalism Coverage

Urban drivers face higher risks of theft or damage. Comprehensive plans cover these risks, giving peace of mind.

Support During Natural Disasters

Hurricanes, floods, and fires can cause major damage. Leading insurers offer coverage and quick claim payouts to get you back on the road.

How to Buy Car Insurance from Top Providers

- Visit the provider’s official website

- Use their online quote tool

- Customize your plan based on budget and needs

- Purchase directly or connect with a local agent

Frequently Asked Questions

What is the best way to compare car insurance quotes?

Use online comparison tools like The Zebra or visit individual provider websites. Enter consistent information for accurate comparisons.

Do I need full coverage or liability only?

It depends on your car’s value, your location, and your financial situation. Full coverage is recommended for newer or financed cars.

Can I change car insurance providers mid-policy?

Yes, you can switch at any time. Be sure to cancel your current policy after confirming the new one to avoid gaps in coverage.

This detailed guide to shopping car insurance companies will help you make an informed decision and potentially save hundreds of dollars each year. Choose smart, drive safe, and get the protection you need today.