Shop Car Insurance Rates in 2025 – Compare & Save Today

Shopping for car insurance rates is essential to ensure you’re getting the best coverage at the most affordable price. With premiums on the rise, comparing rates can lead to significant savings.Kiplinger

By evaluating different insurance providers, you can identify policies that offer the coverage you need without overpaying. Regularly reviewing your options helps you stay informed about new discounts and better deals available in the market.

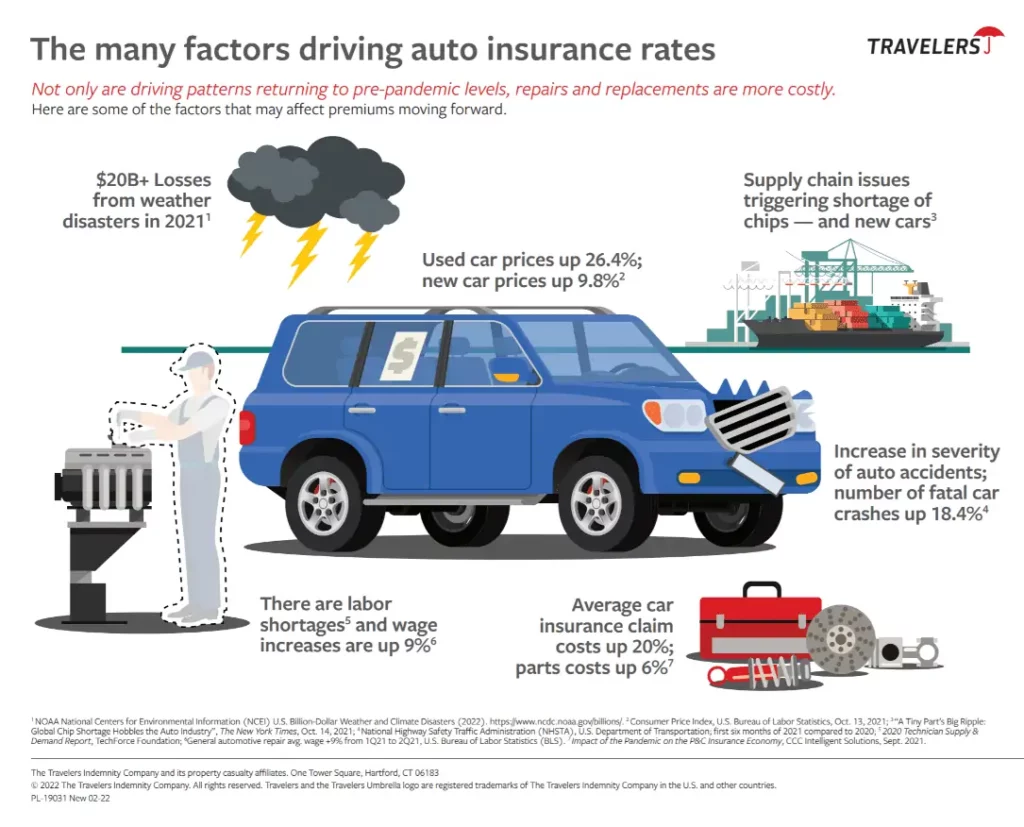

Factors Influencing Car Insurance Rates

Several factors can impact the rates you receive from insurance providers:Money+3Liberty Mutual+3Liberty Mutual+3

- Driving History: A clean record can lead to lower premiums, while accidents or violations may increase rates.

- Vehicle Type: The make, model, and year of your car can affect insurance costs.

- Location: Urban areas may have higher rates due to increased traffic and theft risks.

- Credit Score: In some states, insurers use credit scores to determine premiums.Policygenius

- Coverage Levels: Higher coverage limits typically result in higher premiums.

Top Tools to Compare Car Insurance Rates

The Zebra

The Zebra offers a comprehensive platform to compare car insurance rates from over 100 providers, including GEICO, Progressive, and Allstate. By entering your ZIP code and vehicle information, you can receive personalized quotes in minutes.

NerdWallet

NerdWallet provides an intuitive interface to compare car insurance quotes. Their platform analyzes rates from multiple insurers, helping you find the best deal based on your driving profile.

Insurify

Insurify uses artificial intelligence to match drivers with optimal insurance policies. Their platform provides real-time quotes and highlights available discounts based on your profile.

Policygenius

Policygenius offers a user-friendly platform to compare car insurance quotes. They provide insights into various coverage options and help you understand the nuances of each policy.

ValuePenguin

ValuePenguin provides detailed analyses of car insurance rates across different states and demographics. Their comparison tool helps identify the most affordable options tailored to your needs.

Leveraging Technology for Better Insurance Shopping

Modern technology has revolutionized the way we shop for car insurance. Online comparison tools and mobile apps allow you to:

- Compare Multiple Quotes: Quickly view and compare rates from various insurers.An Insurance Company You Can Rely On+3Insurify+3Policygenius+3

- Customize Coverage: Adjust coverage options to see how they affect your premium.

- Access Exclusive Discounts: Some online platforms offer special discounts not available elsewhere.

- Manage Policies: Easily update information, file claims, and make payments through digital platforms.

Real-World Examples of Car Insurance Providers

GEICO

GEICO offers a variety of discounts, including those for good drivers, military personnel, federal employees, and students. Their user-friendly online platform allows for easy quote comparisons and policy management.

Progressive

Progressive’s Snapshot® program personalizes rates based on your driving behavior. They also offer discounts for bundling policies, signing up online, and being a homeowner.

Liberty Mutual

Liberty Mutual provides numerous discounts, such as multi-policy, multi-car, and safe driver discounts. Their RightTrack® program rewards drivers for safe driving habits by offering additional savings.

Allstate

Allstate rewards safe drivers through their Drivewise® program, which monitors driving habits to offer personalized discounts. They also provide savings for students, new cars, and policy bundling.

State Farm

State Farm offers competitive rates and a range of discounts, including those for safe driving, multiple vehicles, and bundling home and auto policies. Their Drive Safe & Save™ program uses telematics to provide personalized discounts.

Benefits of Bundling Auto and Home Insurance

Bundling your auto and home insurance policies can lead to significant savings. Many insurers offer multi-policy discounts, simplifying your insurance management and reducing overall costs.

In addition to financial benefits, bundling can streamline communication with your insurer, as you’ll have a single point of contact for multiple policies. This convenience can be especially valuable when filing claims or updating policy information.

How to Shop for Car Insurance Rates

- Gather Information: Have your personal details, vehicle information, and current insurance policy ready.

- Use Comparison Tools: Utilize platforms like The Zebra, NerdWallet, or Insurify to compare quotes from multiple providers.

- Identify Discounts: Look for available discounts based on your profile, such as safe driver, multi-policy, or student discounts.

- Evaluate Coverage: Ensure the policies you’re considering provide adequate coverage for your needs.

- Purchase Policy: Once you’ve selected the best option, complete the purchase online or through an agent.

Frequently Asked Questions

Q1: How often should I shop for car insurance rates?

A1: It’s advisable to compare car insurance quotes at least once a year or whenever significant life changes occur, such as moving, buying a new car, or experiencing changes in your driving record.

Q2: Will shopping for quotes affect my credit score?

A2: No, requesting insurance quotes typically involves a soft credit inquiry, which doesn’t impact your credit score.