Shop Auto Insurance Rates: Compare & Save with the Best Car Insurance Quotes

(Image suggestion: A person using a laptop or smartphone with multiple car insurance websites open for comparison)

Shopping for auto insurance rates isn’t just about finding the cheapest option—it’s about finding the best value. With so many insurers offering competitive prices and packages, knowing how to shop auto insurance rates properly can save you hundreds (if not thousands) every year. This guide breaks down everything you need to know, from how rates are calculated, to how you can compare quotes, and which insurers currently offer the best value for your money.

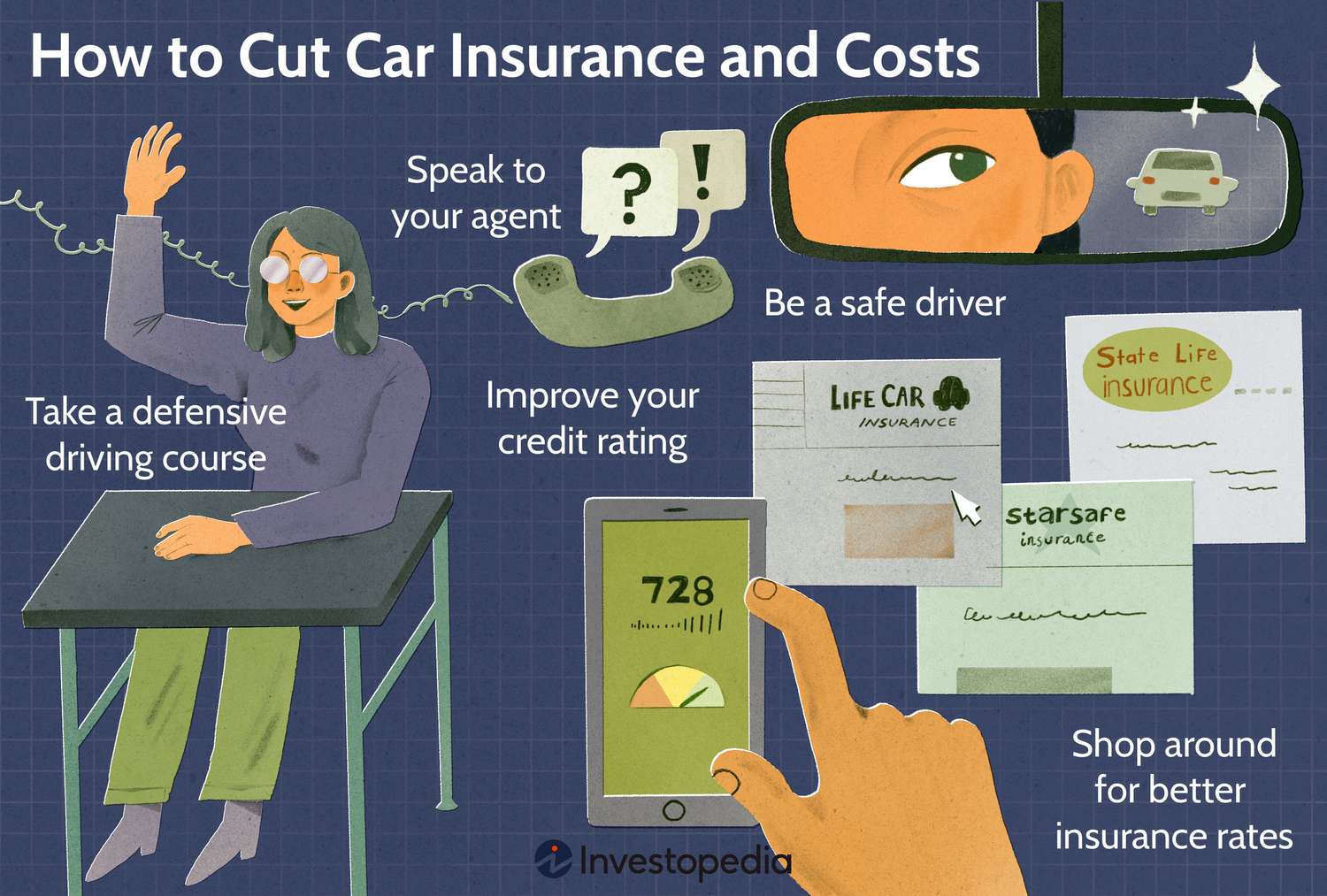

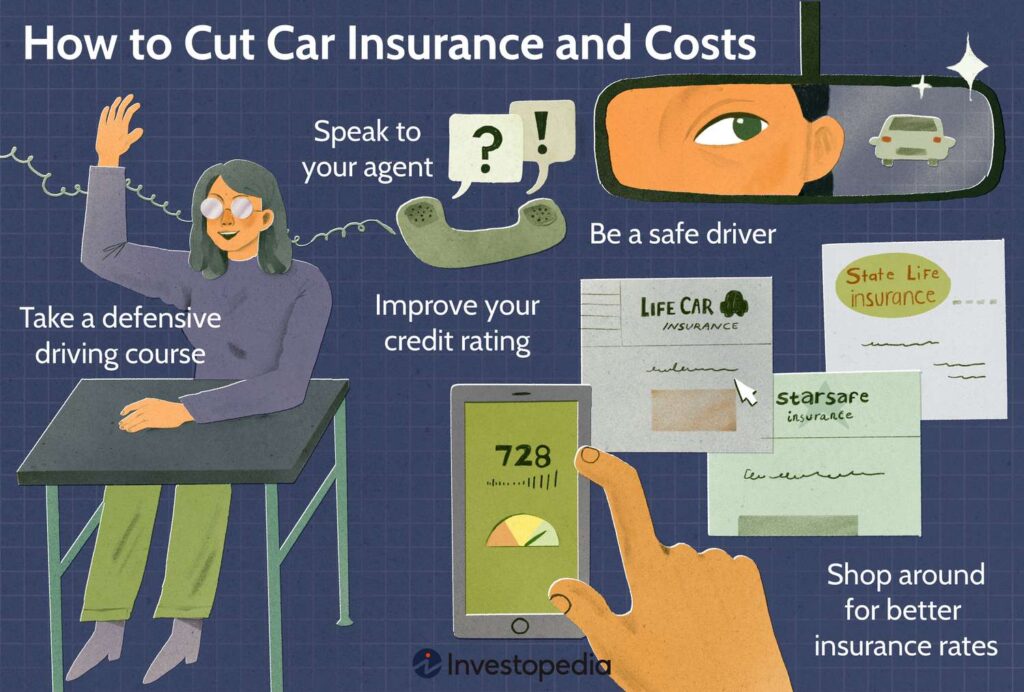

What Does It Mean to Shop Auto Insurance Rates?

When you shop auto insurance rates, you’re actively comparing premium quotes from various insurance providers to find the best coverage for your vehicle at the most affordable price. This process allows you to evaluate not only price differences but also differences in service, coverage options, and available discounts.

Every driver’s profile is different—factors like your location, age, driving record, and the type of vehicle you drive influence how much you’ll pay. That’s why it’s essential to gather quotes from at least three to five companies before making a decision.

Benefits of Shopping for Auto Insurance Rates

(Image suggestion: A graph or visual showing cost savings from comparing insurance rates)

Save Money Year After Year

The primary benefit is savings. Insurance companies frequently adjust their pricing models based on industry trends, so what was a good rate last year may not be this year. Regularly shopping auto insurance rates can help you take advantage of lower premiums, loyalty discounts, or new customer promotions.

Get the Best Coverage for Your Needs

Some insurance policies come with better roadside assistance, faster claims processes, or wider accident forgiveness programs. Shopping around allows you to evaluate these benefits and choose a policy that aligns with your lifestyle and driving habits.

Leverage New Technology and Services

Modern insurers use advanced tech like AI-driven claims handling, telematics, and mobile apps. By comparing quotes, you’ll find which companies offer the latest tools to make insurance easier and more accessible.

Real-World Examples: Best Companies to Shop Auto Insurance Rates In 2025

To help you begin your comparison journey, here are five of the most competitive insurance providers for 2025, each offering unique benefits and easy online quoting tools.

GEICO

One of the biggest names in auto insurance, GEICO is known for fast quotes and competitive rates for most driver profiles.

Details:

- Affordable premiums for safe drivers and military personnel

- Easy online quote tools and mobile app for claims

- Discount options include vehicle equipment, defensive driving, and multi-policy

Use Case:

A young professional commuting 20 miles daily might find that GEICO offers one of the lowest monthly rates, especially when bundled with renter’s insurance.

Where to Buy:

👉 <button>Get a Quote from GEICO</button>

Progressive

Progressive is ideal for people who love transparency and tech, with their Name Your Price® tool making budget shopping easier.

Details:

- Snapshot® telematics program for personalized discounts

- Online comparison tools show you competitor pricing

- Generous discounts for safe driving and paperless billing

Use Case:

A tech-savvy driver with a clean record can reduce their annual cost significantly using Progressive’s Snapshot driving app.

Where to Buy:

👉 <button>Get a Quote from Progressive</button>

Allstate

Allstate combines strong customer service with competitive auto insurance rates and features tailored to families.

Details:

- Drivewise® tracks your driving and rewards you

- Multi-policy and multi-vehicle discounts

- Strong support network of local agents

Use Case:

Families with teen drivers can benefit from Allstate’s Smart Student and teen monitoring features, making premiums more manageable.

Where to Buy:

👉 <button>Get a Quote from Allstate</button>

Liberty Mutual

Liberty Mutual offers personalized rates and an intuitive app for policy management and claims.

Details:

- RightTrack® driving program for discounts up to 30%

- 24/7 customer support and digital claims processing

- New car replacement and better car replacement options

Use Case:

Drivers with new or high-value vehicles benefit from Liberty Mutual’s full replacement features, helping protect against depreciation.

Where to Buy:

👉 <button>Get a Quote from Liberty Mutual</button>

Nationwide

Nationwide stands out with their SmartRide® program and customizable policy structure.

Details:

- Offers usage-based insurance discounts

- Bundling and loyalty perks

- Easy-to-use online platform and mobile app

Use Case:

Urban drivers who use their vehicle infrequently could qualify for substantial savings through Nationwide’s low-mileage discount programs.

Where to Buy:

👉 <button>Get a Quote from Nationwide</button>

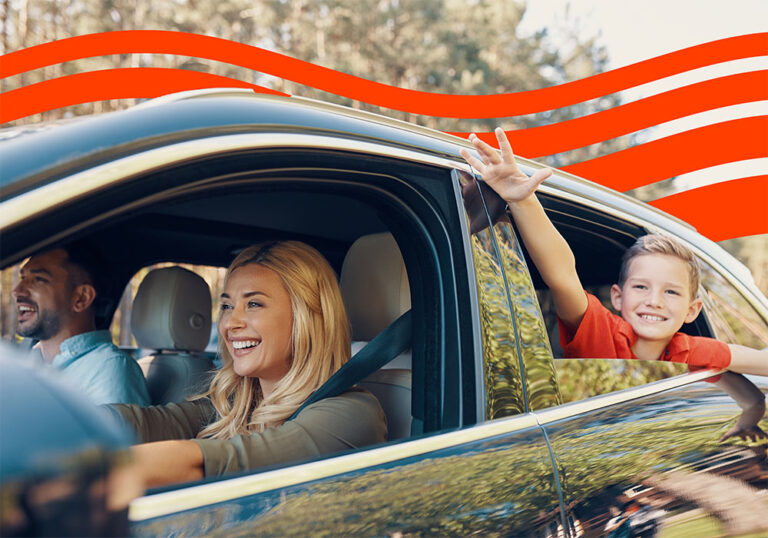

Use Cases: Why People Need to Shop Auto Insurance Rates

(Image suggestion: A driver reviewing policy quotes with a cup of coffee at home)

Life Transitions

Whether you’re moving to a new city, buying a new car, or adding a family member to your policy, it’s the perfect time to re-shop your auto insurance. Rates can vary drastically based on zip code and driving record changes.

After an Accident or Violation

If you’ve recently had an accident or received a ticket, your premiums may rise. However, not all companies penalize the same way. Shopping around lets you find a company that’s more forgiving or offers accident forgiveness.

Annual Rate Increase

Many drivers stick with the same company year after year, only to see their rates climb without notice. Don’t accept rate hikes—shop around and negotiate or switch to a better deal.

How to Shop Auto Insurance Rates Effectively

Step 1: Prepare Your Info

Before you start, gather your vehicle details, driving history, current policy documents, and mileage estimates. This will help you get accurate quotes quickly.

Step 2: Use Comparison Sites

Websites like Policygenius, The Zebra, and Insurify let you enter your info once and get quotes from multiple companies.

Step 3: Request Quotes Directly

While comparison sites are helpful, visiting insurer websites directly can reveal exclusive deals or discounts not listed elsewhere.

Step 4: Analyze Coverage

Don’t just look at the monthly cost. Check the deductibles, coverage limits, and included features to make sure you’re comparing apples to apples.

Step 5: Choose and Buy

Once you find the best rate and coverage, buy online or through a local agent. Make sure you have proof of insurance for your vehicle immediately.

Frequently Asked Questions

How often should I shop auto insurance rates?

At least once a year or anytime your life circumstances change (new car, move, added driver, etc.).

Does shopping around hurt my credit score?

No. Getting quotes typically involves a soft credit check, which doesn’t impact your score.

Can I switch insurance mid-policy?

Yes. You can cancel your current policy anytime, though you may have to pay a small cancellation fee. Always have new coverage active before canceling.

Would you like a PDF version of this article or internal linking suggestions for SEO optimization?