Adverse Credit Car Finance Options – Get Approved with Bad Credit

Adverse credit car finance refers to vehicle financing options available to individuals who have a poor or limited credit history. This could be due to missed payments, defaults, County Court Judgments (CCJs), or even bankruptcy. While traditional lenders may reject such applicants, adverse credit finance providers offer tailored solutions based on the applicant’s current financial situation.

In essence, this type of finance allows customers with bad credit to purchase a car through hire purchase (HP), personal contract purchase (PCP), or personal loans. Rather than focusing on past financial mistakes, these options prioritize affordability and stability, thus making car ownership achievable even with a less-than-perfect credit score.

Why Choose Adverse Credit Car Finance?

Admittedly, adverse credit car finance is a practical solution for those needing reliable transportation but lacking access to traditional finance due to a poor credit score. In many cases, it helps people regain mobility, attend work, manage family needs, or simply restore independence.

Moreover, many providers also report repayments to credit agencies. This means making regular, on-time payments could help improve your credit score over time. Additionally, lenders often work closely with customers to find a payment plan that fits their current budget, thereby minimizing the risk of further financial strain.

Technology Improving Adverse Credit Car Financing

With the rise of fintech innovation, applying for adverse credit car finance has become more accessible, faster, and less stressful than ever before. Online platforms use AI-driven tools and soft credit checks to evaluate applicants without impacting their credit score.

These systems offer instant decisions, real-time comparisons between lenders, and transparent terms. Many providers allow customers to upload documentation securely, track their applications, and even browse approved vehicles on mobile devices. This digital-first approach shortens approval times and enhances the user experience.

Moneybarn Car Finance

Moneybarn is a trusted UK provider that specializes in bad credit car finance. It offers hire purchase agreements with flexible terms and competitive rates tailored to those with adverse credit histories.

Moneybarn focuses on responsible lending. They assess your affordability and offer vehicles through approved dealerships. Applicants can expect dedicated customer service and an efficient online process.

Use Case: Ideal for drivers recently recovering from financial hardship and seeking flexible repayment options.

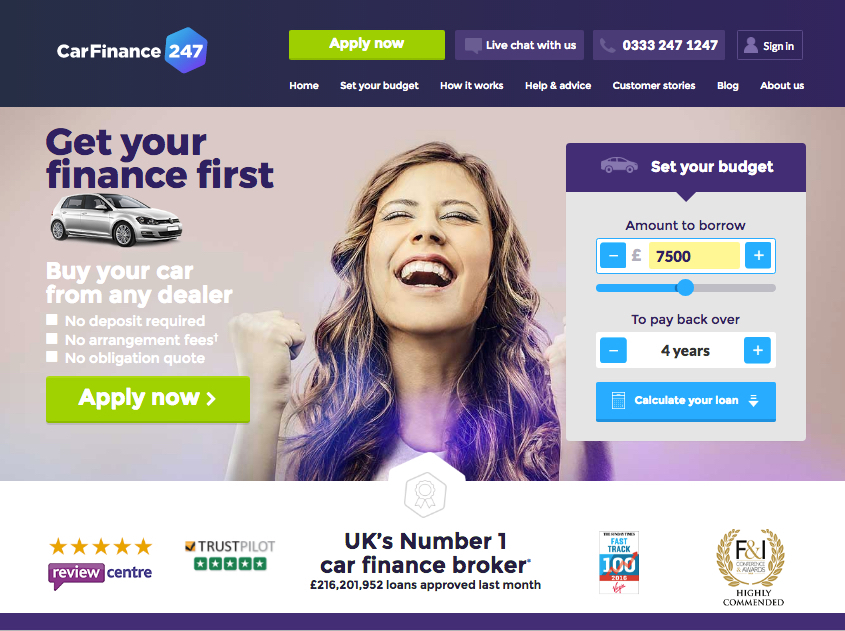

CarFinance 247

CarFinance 247 connects customers with a network of lenders, increasing the chance of approval even with bad credit. They use smart matching technology to pair you with suitable finance options based on your profile.

Furthermore, the platform also offers vehicle sourcing and valuation tools, making it easier for users to find cars within their budget and understand fair market value. After approval, customers can search a large database of used vehicles, knowing they qualify for financing.

Use Case: Perfect for buyers looking for a one-stop platform that handles financing and vehicle sourcing.

Zuto Bad Credit Car Loans

Zuto is a car finance broker that supports customers with a wide range of credit profiles. Their expert advisors walk you through the finance process and help match you with the right lender.

Moreover, Zuto offers both Hire Purchase (HP) and Personal Contract Purchase (PCP) options, giving you the flexibility to choose a finance plan that suits your preferences and credit profile. Their application process is transparent, and their customer service team is highly rated.

Use Case: Recommended for customers who want guided support through the financing process.

Creditplus Car Finance

Creditplus uses an award-winning platform to help bad credit customers secure financing. You fill out a simple online form and receive tailored offers from multiple lenders.

Creditplus also offers a car sourcing service and delivery options across the UK. They provide educational resources and tools to help you understand your finance agreement.

Use Case: Best for those who value a simple application and want full service from finance to car delivery.

The Car Loan Centre

The Car Loan Centre provides in-house financing with no reliance on third-party lenders. They specialize in helping customers who have been declined elsewhere due to severe credit issues.

This provider offers flexible terms, low deposits, and an inclusive approval policy. Customers can choose from a wide selection of vehicles and complete the process online or over the phone.

Use Case: Perfect for applicants with CCJs, defaults, or past bankruptcies needing a guaranteed option.

Benefits of Using Adverse Credit Car Finance

One of the primary benefits is accessibility. Even if you’ve faced credit issues in the past, you can still qualify for a vehicle finance plan tailored to your situation. This allows you to rebuild your credit while maintaining mobility for work, family, and lifestyle needs.

Another advantage is structure. These lenders often offer structured repayment plans that align with your monthly budget. There is also typically a wider acceptance rate, and some even provide cars as part of the package, streamlining the process from financing to vehicle handover.

Use Case: Real-Life Applications

Take Sarah, a teacher who faced financial difficulties during a divorce. With missed credit card payments affecting her credit, she was turned away by traditional lenders. Through Creditplus, she got approved for a reliable used car with manageable payments, allowing her to commute to work and rebuild her credit.

Or consider James, a self-employed graphic designer. His fluctuating income had caused past arrears. He applied through Zuto, was matched with a suitable lender, and got the vehicle he needed to visit clients, boosting his business credibility and growth.

How to Buy and Where to Apply

To get started, choose one of the reputable finance providers listed above. You can complete an application online in minutes. Once approved, select a vehicle from the partner dealerships or receive assistance in sourcing one.

- Apply at Moneybarn

- Apply with CarFinance 247

- Start with Zuto

- Compare Offers at Creditplus

- Apply with The Car Loan Centre

FAQs

Can I get car finance with a very low credit score? Yes. Many adverse credit lenders specialize in working with customers who have very low credit scores. They focus on your ability to repay and current financial circumstances.

Does applying for bad credit car finance affect my credit score? No, most providers start with a soft credit check that doesn’t impact your score. A hard check is only done when you accept a final offer.

What deposit do I need for adverse credit car finance? It varies by lender, but many offer low deposit or even zero deposit options, especially if you meet other affordability criteria.