Auto Loan for Business Owners – Compare Top Lenders & Apply Online

Auto loans for business owners are a powerful financial tool that enables entrepreneurs, freelancers, and small business operators to purchase commercial vehicles without draining their working capital. Whether you’re buying a single delivery van or a fleet of vehicles for a growing enterprise, commercial auto loans are structured to suit your specific business needs.

These loans are often easier to manage with tax-deductible interest, flexible terms, and specialized business loan programs. Knowing how to apply and where to find the best options is key to getting behind the wheel with minimal delays.

Benefits of Auto Loans for Business Owners

One of the primary advantages of using a business auto loan is the separation of personal and business finances. This improves credit structuring and may offer access to higher borrowing limits. Moreover, interest payments on business auto loans can often be deducted as a business expense, providing significant tax advantages.

Another critical benefit is better cash flow management. Instead of making a large, upfront purchase, business owners can spread the cost of the vehicle over several years, freeing up resources for marketing, inventory, or staffing.

Insert image of the product [Ally Business Auto Loan]

Ally Business Auto Loan provides tailored vehicle financing solutions with fast online applications and flexible structures for businesses.

Use Case: Best suited for small-to-medium businesses needing quick vehicle acquisition for delivery or transport services.

Insert image of the product [Bank of America Auto Loan for Businesses]

Bank of America Business Auto Loan offers flexible terms and supports both new and used vehicle purchases.

Use Case: Excellent choice for companies looking to finance multiple vehicles while keeping banking services under one provider.

Insert image of the product [Enterprise Fleet Financing]

Enterprise Fleet Management enables large and small companies to lease and finance commercial vehicles with integrated fleet tracking and service management.

Use Case: Ideal for delivery companies, contractors, and technicians needing fleet oversight and vehicle servicing.

Insert image of the product [SmartBiz SBA Vehicle Loans]

SmartBiz SBA Loans offer long-term, low-interest SBA 7(a) financing that includes options for purchasing business vehicles.

Use Case: Great for qualified small businesses looking for government-backed loans with reduced APR and longer terms.

Insert image of the product [Ford Commercial Financing]

Ford Credit Commercial Financing provides targeted solutions for Ford commercial vehicle purchases, including vans and pickups.

Use Case: Recommended for businesses already aligned with Ford vehicles and seeking direct-from-manufacturer financing options.

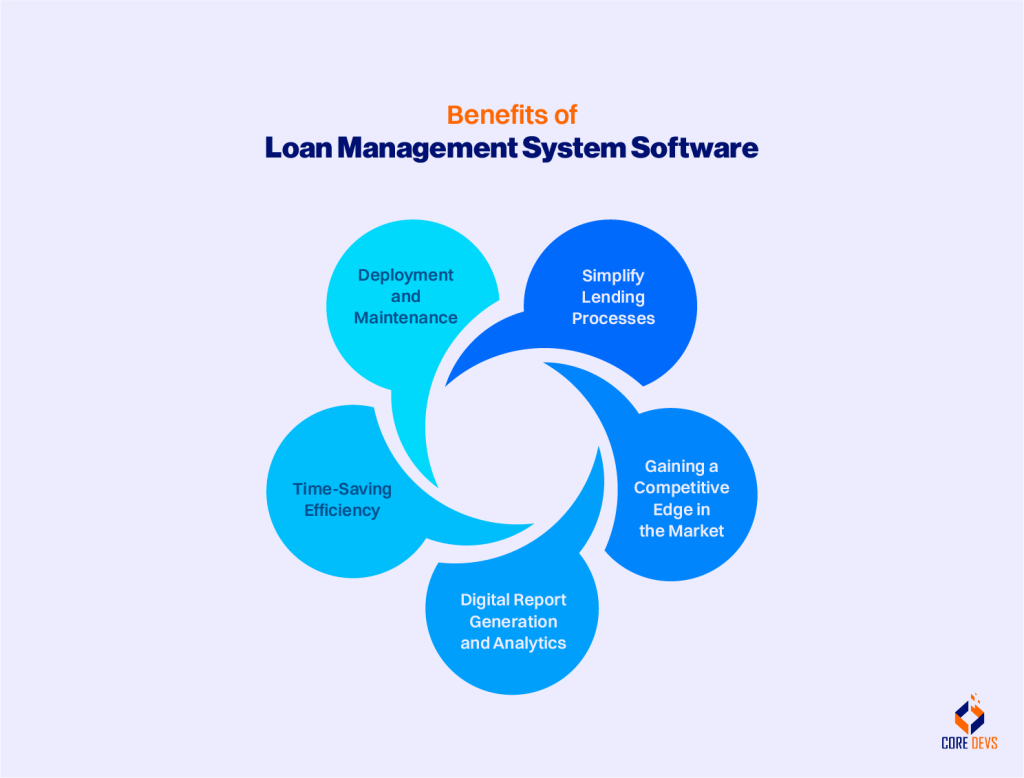

Technology Benefits for Auto Loan Management

Technology-driven loan management platforms streamline application, approval, and ongoing payment processes. Many lenders offer digital document submission, automated approval decisions, and real-time loan dashboards.

Businesses can now integrate loan repayment tracking with accounting software, reducing administrative burdens and helping ensure accurate tax documentation. This tech-backed experience makes it easier than ever to manage financing, especially for busy entrepreneurs.

Use Case: Solving Business Challenges with Auto Loans

A mobile pet grooming startup needed a branded van to launch operations. Using a business auto loan from Ally, they secured a new vehicle with minimal down payment and rolled in custom wrap costs. The company expanded within 6 months, thanks to manageable monthly payments.

Similarly, a landscaping business secured three trucks through Enterprise Fleet Financing. The bundled servicing, insurance, and tracking reduced downtime and boosted productivity across multiple job sites.

How to Apply and Where to Buy

Applying for an auto loan as a business owner typically requires:

- Business license

- EIN (Employer Identification Number)

- Revenue or tax documents

- Vehicle specifications and purchase quotes

Choose from these trusted sources:

- Apply at Ally

- Apply at Bank of America

- Explore Enterprise Fleet

- Apply at SmartBiz SBA

- Finance with Ford

FAQs

Do I need a personal guarantee for a business auto loan? In many cases, lenders may require a personal guarantee unless the business has strong credit and financial history.

Can I write off auto loan interest as a business expense? Yes, interest on business vehicle loans is generally tax-deductible. Consult your accountant for full compliance.

How fast can I get approved for a business auto loan? Depending on the lender and document readiness, approvals can happen within 24 to 72 hours.