American Express Platinum Cashback Everyday – Maximize Rewards on Everyday Spending

The Credit Card is a top tier cash back credit card designed for consumers who want to earn rewards from their routine purchases. With no annual fee, high cashback potential, and solid rewards for everyday categories like groceries, fuel, and online shopping, it’s a go to choice for individuals looking to maximize the value of their regular expenditures.

This article dives into detailed information about this card, including its benefits, use cases, real-world examples, and how to get your hands on one. Whether you’re managing household expenses or simply looking to make the most of your credit, this guide is built for you.

What is the American Express Platinum Cashback Everyday Card?

The Credit Card is a rewards card that provides users with on all eligible purchases without charging an annual fee. Unlike some reward cards that require you to hit a minimum spend to earn, this one allows you to benefit from the first pound you spend. It offers introductory cashback bonuses and ongoing percentage-based cashback based on your spending habits.

It’s a versatile tool for people who use their credit cards for day-to-day expenses and want to earn a return on that spending. This card fits neatly into any lifestyle, whether you’re a frequent online shopper, a commuter, or managing a family budget.

Key Benefits of the American Express Platinum Cashback Everyday Card

The American Express Platinum Cashback Everyday Credit Card offers a wide range of benefits that appeal to everyday users who want financial rewards without added complications. Below, we explore the main benefits in more depth to show exactly how this card brings value to your wallet.

American Express Platinum Cashback Everyday Rewards Breakdown

This card delivers multiple benefits that can significantly add up over time. Here’s how users benefit technologically and financially from this product:

Earn Cashback on Every Purchase

Cardholders earn cashback at a rate that increases based on usage and spending milestones. Typically, there’s an introductory period with higher cashback percentages for new cardmembers. After this period, users earn a base rate on every eligible purchase, with no rotating categories or opt-ins.

No Annual Fee

Unlike many premium cashback or reward cards, the Platinum Cashback Everyday Card does not charge an annual fee. This makes it ideal for individuals who want to earn rewards without worrying about paying to hold the card.

Introductory Bonus

New cardmembers can enjoy a welcome cashback bonus if they meet a minimum spending threshold within the first few months. This can be a great kickstart for rewards if you’re planning larger purchases or holiday shopping.

American Express Offers and Purchase Protection

Users gain access to Amex Offers, which are frequent discounts and extra cashback offers from top retailers. Additionally, purchase protection adds a safety net for online or in-store purchases against theft or damage for a limited period.

Solving Real Financial Challenges

This credit card helps solve common problems consumers face with traditional credit or debit usage. For instance:

- Maximizing value from fixed monthly expenses: Users can pay bills like groceries, fuel, and subscriptions with the card and earn cashback in return.

- Budget control with benefits: Rather than spending blindly, users are more motivated to make purchases thoughtfully to earn rewards.

- Safe and protected spending: With Amex’s built-in purchase protection and customer support, users can shop with peace of mind both online and offline.

It’s a strategic way to offset the cost of essentials while enjoying added protections and perks that a basic debit card can’t offer.

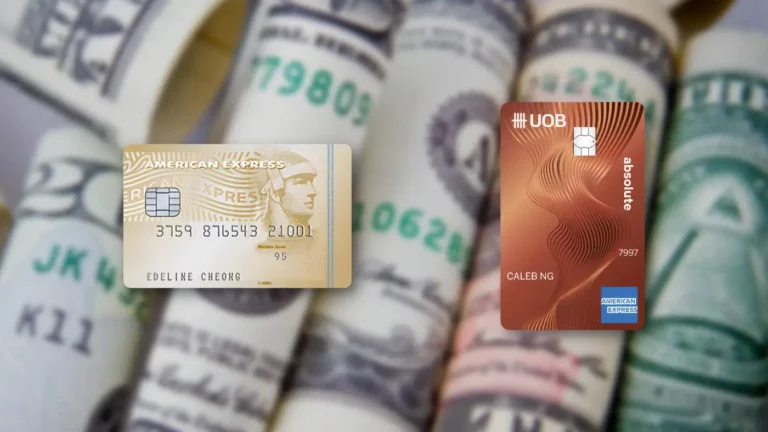

Real-World Examples of Related Cashback Credit Cards

Let’s take a closer look at five other credit cards similar to the American Express Platinum Cashback Everyday Card. These options provide context and help users find the card that fits best with their lifestyle.

American Express Platinum Cashback Credit Card

The upgraded sibling to the Everyday version, this card offers even higher cashback rates but it comes with an annual fee. It’s ideal for high spenders who want maximum return on every pound spent.

- Best for: Frequent spenders and those with higher monthly budgets

- Bonus: Higher introductory cashback rates and enhanced travel perks

Barclaycard Rewards Card

This no-fee credit card also offers cashback on everyday spending and no foreign transaction fees great for travelers or international shoppers.

- Best for: International use and travel purchases

- Benefit: No fees abroad, decent rewards, and purchase protection

HSBC Cashback Credit Card

This card provides competitive cashback on UK and international purchases and can be a strong contender for loyal HSBC customers.

- Best for: HSBC customers who want cashback rewards

- Perk: Linked banking ecosystem and premium offers

Santander All in One Credit Card

A balance of cashback and perks, this card charges a small monthly fee but offers cashback on all spending and zero foreign transaction fees.

- Best for: Global travelers and moderate spenders

- Extra: Travel-friendly perks and cashback on all categories

Capital One Rewards Credit Card

This card is tailored toward individuals rebuilding credit while still earning basic cashback benefits.

- Best for: Credit builders looking for rewards

- Standout: Access to cashback while improving credit profile

Why People Choose the Amex Platinum Cashback Everyday Card

This card is often chosen because of its seamless integration into a modern lifestyle. People want to earn money back on everyday spending without having to track rotating categories or points programs. With the Platinum Cashback Everyday card, they can simply “spend and earn.”

Another reason is the Amex mobile app, which offers detailed tracking of transactions, cashback earnings, and spend management. The ease of use, transparency, and digital-first approach make it particularly appealing to tech-savvy users.

How to Buy and Where to Get It

Getting the Card is simple and can be done in a few steps:

- Visit the official Amex UK website

- Check your eligibility with their quick check tool (doesn’t impact your credit score)

- Apply online and provide your personal, employment, and income details

- Receive approval decision (sometimes instantly)

Here’s where you can apply:

<a href=”https://www.americanexpress.com/uk/credit-cards/platinum-cashback-everyday-credit-card/” target=”_blank”><button style=”padding: 10px 20px; background-color: #0077cc; color: white; border: none; border-radius: 6px;”>Apply Now for Amex Platinum Cashback Everyday</button></a>

FAQs

What is the cashback rate on the card?

The base cashback rate is typically up to 0.5% on all eligible purchases, with an introductory bonus rate of up to 5% on purchases in the first 3 months (subject to spending conditions).

Is there an annual fee for the Amex Platinum Cashback Everyday card?

No, this card does not have an annual fee, which makes it an excellent choice for long-term cashback accumulation without ongoing costs.

Can I use this card for international purchases?

Yes, but foreign transaction fees apply. For international use, an alternative card with no FX fees might be more suitable, like the Barclaycard Rewards Credit Card.