Best Way to Shop Car Insurance Rates Online: Top Providers, Benefits, and Buying Tips

How to Shop Car Insurance Rates Effectively and Save More in 2025

Insert image of the product

Shopping for car insurance rates can feel overwhelming with all the options out there. But with a strategic approach, you can not only simplify the process but also save hundreds of dollars annually. Whether you’re switching providers, bundling policies, or just comparing prices, understanding the right way to shop car insurance rates is critical in 2025.

Here’s a deep dive into how you can evaluate insurance companies, understand rate variables, compare benefits, and find the best coverage for your needs—without overpaying.

Why Shopping Car Insurance Rates Matters More Than Ever

Car insurance is a necessity, not an option. Yet many people stick with their current provider without checking if better deals are available. Insurance companies use different criteria to calculate premiums—things like age, driving history, zip code, and credit score.

Shopping car insurance rates helps you:

- Discover better deals and discounts

- Customize your policy based on evolving needs

- Take advantage of new technology and telematics

- Avoid overpaying for outdated or irrelevant coverage

By actively comparing rates, you’re in control—not the insurance company.

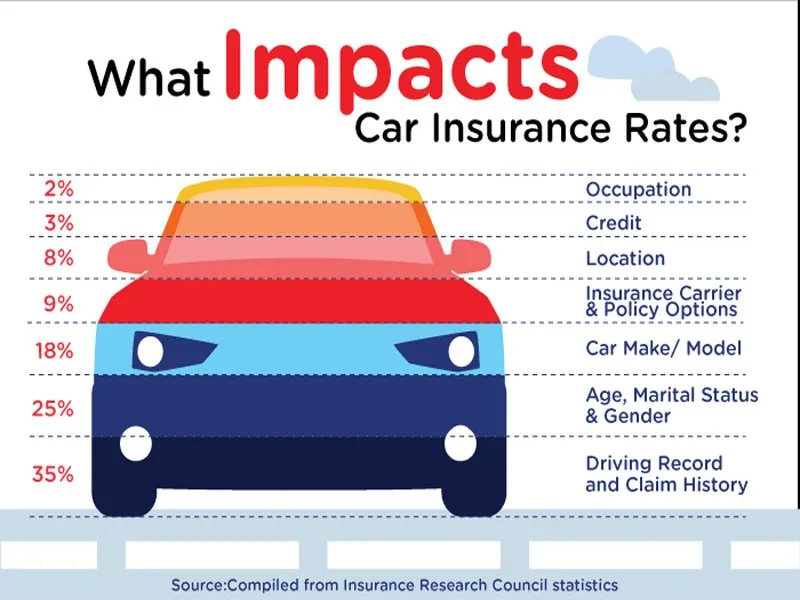

What Affects Your Car Insurance Rates

Insert image of the product

Many factors influence how much you’ll pay for car insurance. Understanding these helps you get accurate quotes and fair pricing when comparing providers.

- Driving Record: Accidents, tickets, and DUIs significantly increase your rates.

- Location: Urban areas typically have higher premiums due to increased risk.

- Age and Gender: Younger and male drivers often face higher premiums.

- Credit Score: In most states, better credit means better insurance rates.

- Vehicle Type: Expensive, sporty, or high-theft-risk cars cost more to insure.

- Coverage Levels: Higher limits and lower deductibles increase premiums.

- Mileage: Driving less may qualify you for a low-mileage discount.

Benefits of Comparing Car Insurance Rates Online

Thanks to technology, shopping for car insurance rates is more streamlined and user-friendly than ever. Here are some major benefits:

- Real-Time Quotes: Most online platforms deliver instant, customized quotes.

- Comparison Tools: Side-by-side comparison helps visualize what each policy includes.

- Bundling Options: Easily explore discounts for combining home, auto, and renters insurance.

- Digital Policy Management: Some companies allow full digital onboarding and claims management.

- Access to Customer Reviews: Get real-world feedback from other users before you commit.

The more informed you are, the better decisions you can make about your policy.

Top 5 Real-World Examples of Car Insurance Products to Compare

- GEICO offers one of the most intuitive online quote tools and a range of customizable options. Their competitive pricing and discounts for safe drivers, federal employees, and military members make it a top choice. Why Choose GEICO?

- 24/7 customer support and roadside assistanceHighly-rated mobile app with claims and policy toolsDriveEasy program rewards safe driving

A busy professional who drives under 10,000 miles a year can benefit from GEICO’s low-mileage discounts and app-based telematics to reduce premiums.

- Progressive’s Snapshot program uses real-time driving behavior to calculate personalized premiums. Their online tools also allow you to compare competitors’ rates directly from their site. Why Choose Progressive?

- Great for tech-savvy users who want usage-based pricingOffers accident forgiveness and deductible savings bankLarge provider network with flexible coverage

A family with teenage drivers can use Snapshot to monitor and improve driving habits while potentially saving on premiums.

- State Farm’s telematics program tracks mileage and driving behavior via a mobile app or vehicle plug-in, offering up to 30% savings for good drivers. Why Choose State Farm?

- Personalized service from local agentsMulti-policy discounts and family bundlingReliable claims service and high customer satisfaction

Retirees or remote workers who drive less can benefit from substantial savings through the Drive Safe & Save program.

- Exclusive to military members and their families, USAA consistently ranks high for customer satisfaction and claims support. Why Choose USAA?

- Top-rated claims serviceDiscount options for garaged vehicles, safe drivers, and military storageFinancial tools and banking integration

Active-duty military personnel with frequent deployments can take advantage of storage discounts and excellent customer support.

- Allstate’s Drivewise tracks your driving habits and rewards you with cashback every six months for safe driving. Why Choose Allstate?

- Real-time feedback to improve drivingAccident forgiveness and new car replacement availableEasy bundling with renters or homeowners insurance

A young urban driver concerned about safety and rewards will benefit from instant feedback and potential discounts.

Use Case: Why People Shop for Car Insurance Rates

People shop for car insurance for various reasons, but the most common problems they aim to solve include:

- High Monthly Premiums: Many discover they’re overpaying when they start comparing.

- Life Changes: A new car, marriage, move, or teen driver in the household can change coverage needs.

- Poor Customer Service: Some leave providers due to slow claims or unresponsive support.

- Lack of Customization: Modern insurers offer more flexible options tailored to lifestyle and risk.

Shopping around helps solve these issues by providing better rates, better service, and better coverage—all in one place.

How to Buy Car Insurance Online

The process of buying car insurance online has never been easier. Here’s how:

- Gather Personal Information

You’ll need your driver’s license number, VIN, address, and current policy details. - Use a Comparison Website or Go Direct

Use trusted platforms like Policygenius, NerdWallet, or go directly to providers like GEICO or Progressive. - Compare Plans Side-by-Side

Look beyond price—compare deductibles, limits, add-ons, and customer reviews. - Select and Purchase

Once you’ve chosen a policy, you can purchase it directly online or through a licensed agent. - Download the Mobile App

Many insurers provide apps to manage claims, access ID cards, and monitor your policy.

Where to Buy Online:

- <a href=”https://www.geico.com” target=”_blank”><button>Buy GEICO Car Insurance</button></a>

- <a href=”https://www.progressive.com” target=”_blank”><button>Buy Progressive Insurance</button></a>

- <a href=”https://www.statefarm.com” target=”_blank”><button>Buy State Farm Insurance</button></a>

- <a href=”https://www.usaa.com” target=”_blank”><button>Buy USAA Insurance</button></a>

- <a href=”https://www.allstate.com” target=”_blank”><button>Buy Allstate Insurance</button></a>

FAQ: Shopping Car Insurance Rates

1. How often should I shop for car insurance rates?

You should compare rates at least once a year or after any major life event like moving, getting married, or buying a new car.

2. Does shopping around hurt my credit score?

No, requesting insurance quotes is a soft inquiry and won’t affect your credit score.

3. Can I switch insurance companies anytime?

Yes, you can switch providers at any time. Just make sure there’s no lapse in coverage, and check if there are cancellation fees.