Business Auto Loan Application Guide – Fast Approval & Financing Options

Understanding Business Auto Loan Applications

A business auto loan application is a financial product designed for companies that need vehicles to operate efficiently. Whether it’s for delivery, logistics, sales, or service fleets, these loans are tailored to meet the demands of business vehicle financing. They help businesses acquire vehicles without dipping into working capital.

These loans differ from personal auto loans. They are based on business creditworthiness, revenue history, and sometimes, the owner’s credit. Understanding how they work, what documents are needed, and which lenders offer the best options can make a significant difference in approval speed and interest rates.

Key Benefits of Business Auto Loan Applications

Improved Cash Flow Management

Financing business vehicles through loans helps manage cash flow effectively. Instead of paying a large upfront amount, businesses can allocate funds for other crucial operations.

Asset Ownership and Tax Benefits

Unlike leasing, business auto loans give companies ownership of the vehicle. This can translate to depreciation benefits, potential tax deductions, and equity building over time.

Build Business Credit Profile

Consistent repayments on a business auto loan can help build or improve your business credit score, opening up more financing opportunities in the future.

Top Business Auto Loan Products to Consider

1. Ford Credit Commercial Financing

Ford offers tailored commercial vehicle financing options ideal for small to large enterprises. Their plans include flexible terms, seasonal payment options, and access to their Commercial Line of Credit.

The product is especially beneficial for fleet management, offering volume discounts and service plans. Their loan terms range from 24 to 72 months, with competitive interest rates and pre-approval available online.

Use Case: Ideal for companies in delivery or field services needing multiple vans or trucks. Helps streamline fleet acquisition with fixed monthly costs.

How to Buy: Visit your local Ford dealership or start your application online via the link above.

2. GM Financial Business Lending

GM Financial provides business auto loans for Chevrolet, GMC, and Buick vehicles. They offer both retail and lease options for businesses.

Their Fleet & Commercial division is tailored for companies needing multiple vehicles, offering special programs like Business Choice with cash allowances on upfits.

Use Case: Excellent for construction, plumbing, and mobile service businesses. Provides vehicles built for utility with favorable financial terms.

How to Buy: Start your application on their website or through an authorized dealership.

3. Toyota Commercial Financing

Toyota’s commercial vehicle loan program supports businesses with financing on their popular and reliable vehicles. Options include retail financing and balloon financing for reduced monthly payments.

They provide support for single purchases and fleet acquisitions, making them ideal for startups and growing companies alike.

Use Case: Suitable for service businesses and rideshare companies needing fuel-efficient, low-maintenance vehicles.

How to Buy: Apply online or through your local Toyota dealer.

4. Ally Commercial Vehicle Financing

Ally offers flexible vehicle loan options for businesses, including new and used vehicles. They also support specialty vehicle financing.

Their services include fleet management tools, maintenance support, and upfit financing. With competitive rates and tailored terms, they cater to a wide range of business needs.

Use Case: Great for courier and last-mile delivery services looking to finance electric or hybrid vans.

How to Buy: Apply directly through the Ally website or a partnered dealership.

5. Bank of America Business Auto Loan

Bank of America offers straightforward business vehicle loans with fixed interest rates and flexible terms. Loan amounts start from $10,000.

They offer a preapproval process and guidance throughout the application. Their services suit both small businesses and large companies.

Use Case: Perfect for businesses purchasing a single vehicle or a small fleet. Offers transparency and nationwide availability.

How to Buy: Apply online or visit a local Bank of America branch.

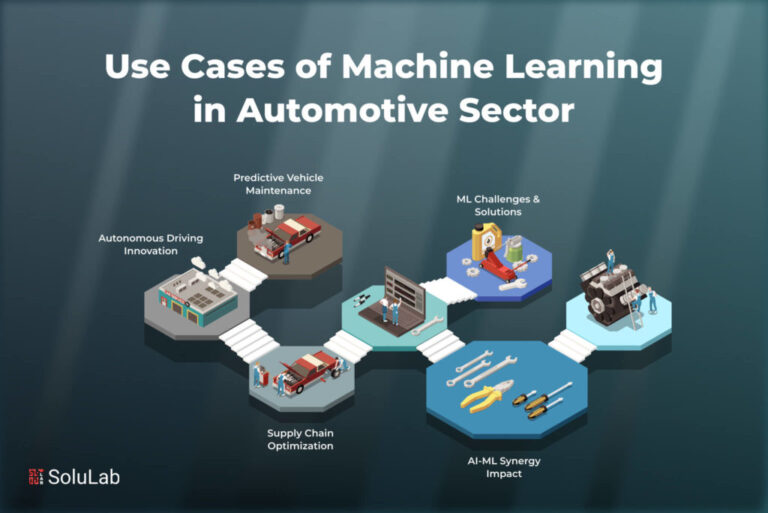

Benefits of Using Technology in Business Auto Loan Applications

Faster Approval with Online Tools

Digital platforms have streamlined the loan application process. Businesses can now apply, upload documents, and receive decisions within hours rather than days. This reduces downtime and increases operational efficiency.

Document Management and Tracking

With online dashboards and customer portals, businesses can easily track the status of their application, access repayment schedules, and manage multiple vehicle loans from one platform.

Data-Driven Loan Decisions

Modern lenders use advanced analytics to assess risk, improving the chances of approval for businesses with solid operational data even if they lack a long credit history.

Use Cases and Common Problems Solved

Problem: A small delivery company needs to expand its fleet to meet increased demand but lacks sufficient cash reserves.

Solution: A business auto loan allows the company to purchase new delivery vans without disrupting cash flow. Using online applications, they can get fast approval and begin operations almost immediately.

Problem: A construction firm wants to acquire specialized trucks but has seasonal income.

Solution: Choosing a lender like Ford or Ally that offers seasonal payment options solves the issue, aligning payments with cash flow.

Problem: A new business lacks extensive credit history.

Solution: Some lenders evaluate cash flow and time in business, offering more flexible criteria to help newer businesses acquire necessary vehicles.

How and Where to Apply for a Business Auto Loan

Most lenders allow online applications. To apply:

- Prepare business financial statements and legal documents

- Choose the vehicle or fleet type

- Select a lender that matches your needs

- Apply directly on their website

Apply for a Business Auto Loan Now

FAQs

What credit score is needed for a business auto loan?

Typically, lenders prefer a business credit score or a personal credit score above 650, but many also consider cash flow and revenue.

Can I get a business auto loan with no personal guarantee?

Some lenders offer no personal guarantee loans, but this usually requires strong business credit and solid financials.

Are used vehicles eligible for business auto loans?

Yes, many lenders allow used vehicles, especially if they meet certain age and mileage requirements.