Apply for a Business Auto Loan – Fast Financing for Commercial Vehicles

A business auto loan is a financing solution that allows companies to purchase commercial vehicles without paying the full cost upfront. These loans are tailored specifically for businesses that rely on vehicles to operate, whether it’s for deliveries, mobile services, sales calls, or transportation of goods and staff.

The loan typically covers a variety of vehicles including cars, trucks, vans, and specialty vehicles used in various industries. The application process focuses on the company’s financial health, business credit, and vehicle type. Business auto loans often have different approval criteria than personal loans, and they help preserve working capital while providing tax advantages through depreciation and interest deductions.

The Benefits of Applying for a Business Auto Loan

One of the primary advantages of a business auto loan is the ability to grow your fleet without exhausting your cash flow. With predictable monthly payments, companies can manage budgeting more effectively.

Business loans also protect personal credit, as they’re under the company’s name. They build your business credit profile and often come with flexible terms and specialized programs for startups, seasonal businesses, and fleets. By securing your vehicles through financing, your business can remain agile and competitive in any market.

Technology Makes Business Auto Loan Applications Easier

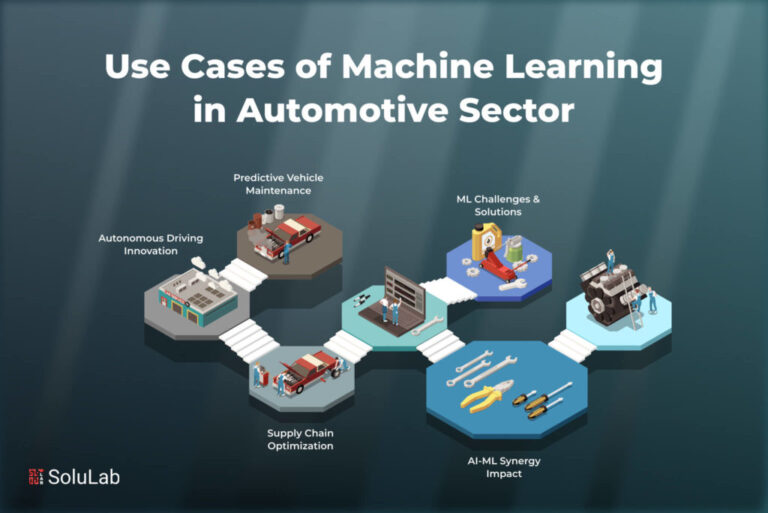

Modern loan platforms use AI and machine learning to evaluate applications faster and more accurately. Many now integrate with accounting software to streamline documentation, while offering pre-approvals and funding within a few business days.

These digital systems also help match you with lenders who are a good fit for your industry and needs. Some fintech platforms even allow you to manage your entire loan life cycle—from application to repayment—within a single dashboard.

Bank of America Business Auto Loan

Bank of America Business Auto Loan offers fixed-rate financing for new and used commercial vehicles with fast online prequalification and competitive interest rates.

Use Case: Ideal for established businesses seeking long-term, reliable financing for their growing fleet needs.

Wells Fargo Equipment Express Loan

Wells Fargo Equipment Express Loan includes business vehicle loans under its broader equipment financing umbrella. It features rapid application reviews and generous loan amounts.

Use Case: Best for companies purchasing multiple vehicles or those needing bundled financing for both vehicles and equipment.

Bluevine Business Loans

Bluevine provides flexible lines of credit and term loans that can be used for business vehicle purchases. Their fast approval process and minimal paperwork are tailored to small business owners.

Use Case: Great for startups and growing businesses looking for short-term financing with minimal barriers.

National Funding Business Auto Financing

National Funding specializes in commercial vehicle financing for small to mid-sized businesses. They offer flexible terms and focus on customer service.

Use Case: Perfect for businesses needing a quick turnaround and working with less-than-perfect credit.

SmartBiz SBA Auto Loans

SmartBiz connects businesses with SBA-backed loan options for vehicle financing. Their service is best for borrowers who want low interest rates and longer repayment periods.

Use Case: Best for businesses with strong credit that want to take advantage of SBA terms and security.

Real-World Use Cases and How Business Auto Loans Solve Problems

Imagine a mobile pet grooming company that needs three vans to expand services across a new region. By applying for a business auto loan through Bluevine, the owner secured funding in under a week, allowing the business to scale operations without tapping into their emergency fund.

Or consider a logistics company that won a major contract but needed to add five trucks to meet delivery demands. With National Funding, they quickly acquired the trucks and paid off the loan in 18 months, increasing revenue by 35%.

How to Apply and Where to Get Started

Each lender offers online applications, often with fast prequalification. Required documents typically include business tax returns, bank statements, and an equipment purchase invoice or quote.

- Apply with Bank of America

- Start with Wells Fargo

- Explore Loans with Bluevine

- Apply at National Funding

- See SBA Loan Options at SmartBiz

FAQs

What credit score is needed for a business auto loan? Most lenders prefer a business credit score of 80+ and a personal score of 600+, but some will work with lower scores depending on financial strength and time in business.

Can I finance used commercial vehicles? Yes, most business auto loan providers finance both new and used vehicles. The loan terms may vary based on the vehicle’s age and condition.

Is a down payment required? It depends on the lender and your credit profile. Some offer 100% financing, while others may require 10–20% down.