Business Car Loan Application – Comprehensive Guide for Small Businesses

Understanding Business Car Loans

A business car loan is a financing option that allows companies to purchase vehicles necessary for their operations. Unlike personal auto loans, business car loans are tailored to meet the specific needs of businesses, considering factors like the company’s creditworthiness and the vehicle’s intended commercial use.

These loans typically require documentation such as a business license, Employer Identification Number (EIN), and financial statements. Lenders assess the business’s credit history and financial health to determine eligibility and loan terms.Chase

Benefits of Business Car Loans

Financial Flexibility

Business car loans provide companies with the flexibility to acquire vehicles without depleting their cash reserves. This allows businesses to allocate funds to other critical areas such as inventory, marketing, or expansion.

Tax Advantages

Interest payments on business car loans and depreciation of the vehicle may be tax-deductible, offering potential savings. It’s advisable to consult with a tax professional to understand the specific benefits applicable to your business.

Building Business Credit

Timely repayments on a business car loan can help establish and improve the company’s credit profile, which is beneficial for future financing needs.

Top Business Car Loan Providers

Bank of America Business Advantage Auto Loan

Bank of America offers the Business Advantage Auto Loan, suitable for purchasing or refinancing cars, vans, and light trucks. Key features include:Bank of America+4NerdWallet: Finance smarter+4Bank of America+4

- Loan amounts starting at $10,000.NerdWallet: Finance smarter

- 30-day rate lock guarantee, allowing businesses time to shop for the right vehicle.Bank of America+1NerdWallet: Finance smarter+1

- Competitive interest rates.Reddit+2NerdWallet: Finance smarter+2Investopedia+2

Eligibility requires the business to be operational for at least two years, and the vehicle must meet specific criteria regarding age and mileage.NerdWallet: Finance smarter

PNC Small Business Vehicle Finance Loan

PNC Bank provides financing for new and used passenger vehicles used for business purposes. Features include:Navy Federal Credit Union+2NerdWallet: Finance smarter+2PNC Bank+2

- Loan amounts ranging from $10,000 to $250,000.Navy Federal Credit Union+2NerdWallet: Finance smarter+2Truist+2

- Fixed interest rates with terms up to 72 months.

- Application process available over the phone or at a branch.NerdWallet: Finance smarter

PNC’s loan is ideal for businesses seeking to finance vehicles essential for daily operations.

Ally Bank Business Auto Loan

Ally Bank offers business auto loans without requiring a personal guarantee, making it an attractive option for businesses looking to separate personal and business finances. They provide:business.ecredable.com+1NerdWallet: Finance smarter+1

- Financing for a variety of commercial vehicles.

- Flexible terms tailored to business needs.Investopedia+3Navy Federal Credit Union+3BBVA API_Market+3

Ally’s approach is beneficial for businesses aiming to preserve capital and maintain financial flexibility.Ally+1Investopedia+1

Truist Bank Small Business Auto Loans

Truist Bank offers auto loans for small businesses with features such as:Truist

- Loan amounts up to $250,000.Truist+1NerdWallet: Finance smarter+1

- Terms up to 75 months.Truist

- Up to 100% financing available, plus 10% for soft costs.Truist

Truist’s loans are suitable for businesses looking to upgrade or replace their vehicles while potentially benefiting from tax deductions.Truist

Navy Federal Credit Union Secured Term Loans

Navy Federal offers secured term loans that can be used for vehicle purchases, featuring:Navy Federal Credit Union

- Minimum loan amounts of $10,000.

- No prepayment penalties.Navy Federal Credit Union

- Loan-to-value ratios up to 75%, depending on the equipment.Navy Federal Credit Union

These loans are ideal for businesses seeking to strengthen or expand their operations with new vehicles.

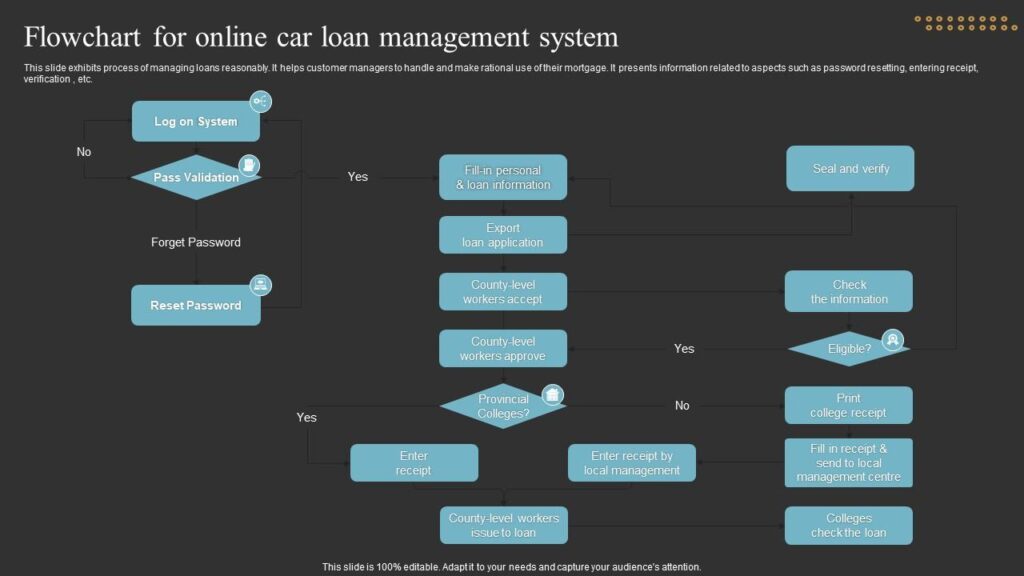

Application Process for a Business Car Loan

Step 1: Assess Your Business Needs

Determine the type and number of vehicles required for your operations. Consider factors such as the vehicle’s purpose, expected mileage, and any special features needed.

Step 2: Review Your Business Credit

Lenders will evaluate your business credit history. Obtain your business credit report to identify any issues that need addressing before applying.Chase

Step 3: Gather Necessary Documentation

Prepare the following documents:

- Business license and registration.

- Employer Identification Number (EIN).

- Financial statements, including income statements and balance sheets.

- Business tax returns.

- Details about the vehicle(s) to be purchased, such as make, model, year, and VIN.

Step 4: Choose a Lender

Research and compare lenders based on interest rates, loan terms, and eligibility requirements. Consider reaching out to multiple lenders to find the best fit for your business.

Step 5: Submit the Application

Complete the lender’s application form, providing all required information and documentation. Be prepared to answer questions about your business operations and financial health.

Step 6: Review Loan Terms

Upon approval, carefully review the loan agreement, paying attention to interest rates, repayment terms, and any fees. Ensure you understand all aspects before signing.

Use Cases: How Business Car Loans Solve Operational Challenges

Enhancing Delivery Services

A small catering business experiencing increased demand may need additional vehicles to ensure timely deliveries. A business car loan enables the company to acquire the necessary vehicles without straining cash flow, thus maintaining service quality and customer satisfaction.

Expanding Service Areas

A cleaning service aiming to expand into new neighborhoods requires more vehicles for its staff. Financing through a business car loan allows the company to grow its service area and customer base efficiently.

Upgrading Aging Fleet

A construction company with aging trucks faces frequent maintenance issues, leading to project delays