Chase Small Business Auto Loan – Apply Online for Fast & Flexible Financing

A Chase small business auto loan is a type of financing tailored for companies looking to purchase vehicles for commercial use. This can include sedans for sales teams, vans for deliveries, or trucks for logistics. Chase Bank offers financing options with competitive rates, flexible terms, and tools designed to simplify the borrowing process.

These loans are designed to support business growth by enabling companies to expand their fleet without depleting cash reserves. Businesses can finance new or used vehicles, and some programs even allow refinancing of existing loans to reduce payments.

Benefits of a Chase Small Business Auto Loan

One of the main advantages of choosing Chase for a business auto loan is the access to low APRs and customizable repayment terms. This helps small businesses manage cash flow more effectively while acquiring the transportation assets they need to operate efficiently.

In addition to favorable loan terms, Chase provides support through business banking services. Businesses can integrate vehicle loans with their overall Chase account management, offering one streamlined platform for their financial needs.

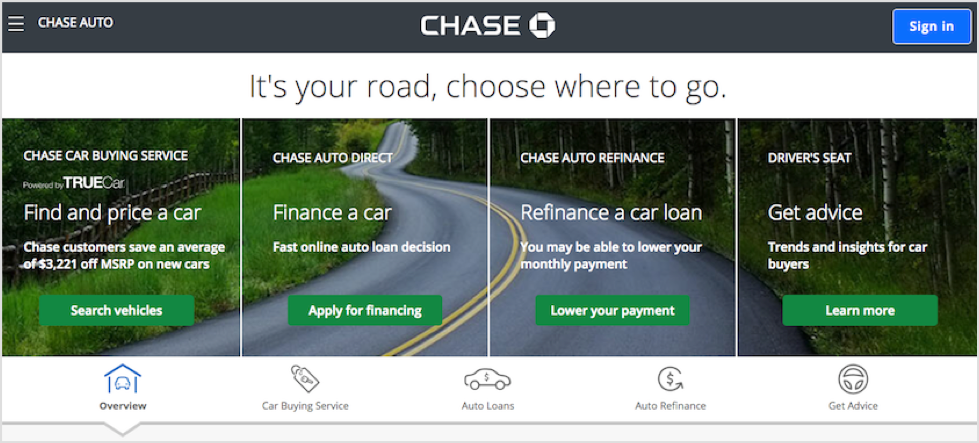

Insert image of the product [Chase Auto Financing for Business]

Chase Auto Loans provides access to business vehicle financing with a straightforward application process. Applicants can apply online or visit a Chase branch to speak with a loan officer.

Use Case: Ideal for companies with existing Chase business banking relationships who want to leverage their credit profile for faster approvals.

Insert image of the product [SmartBiz Loans for Auto Purchase]

SmartBiz Loans partners with SBA-preferred lenders and banks like Chase to offer business vehicle loans. Their platform makes it easy to prequalify online and compare rates.

Use Case: Great for startups and small businesses seeking SBA-backed financing for commercial vehicle purchases.

Insert image of the product [LendingTree Commercial Auto Loans]

LendingTree offers comparison tools for business auto financing, including Chase loan options. Businesses can fill out one form and access multiple quotes.

Use Case: Best for business owners wanting to evaluate multiple lenders before selecting a Chase-backed offer.

Insert image of the product [Nav Business Auto Loan Marketplace]

Nav offers insights and comparisons on Chase and other commercial auto lenders. Their platform shows loan options based on your business credit profile.

Use Case: Ideal for businesses working to build or repair business credit while shopping for vehicle financing.

Insert image of the product [Bank of America Small Business Vehicle Loans]

Bank of America Vehicle Loans competes with Chase by offering similar auto financing products. Reviewing their offerings can help businesses compare terms and decide if Chase is the best fit.

Use Case: Useful for comparison shoppers seeking the best deal across top-tier banks.

Why Small Businesses Choose Chase for Auto Financing

Many small business owners choose Chase for its stability, comprehensive business support, and easy-to-use banking infrastructure. With a nationwide network of branches, online tools, and experienced advisors, Chase simplifies the financing process.

Additionally, if your business has an established relationship with Chase, you may qualify for better rates or expedited loan approval. Their underwriting process considers your total business profile, not just the vehicle.

Technology and Online Application Process

Chase has streamlined the business auto loan application process through its online banking portal. Applicants can log in to their business account, enter vehicle details, and upload supporting documents like business tax returns and bank statements.

Technology enables a smoother approval experience with real-time notifications, electronic document signing, and status tracking. This reduces the time to funding and eliminates paperwork delays.

How a Chase Auto Loan Solves Business Challenges

Business owners often struggle with maintaining liquidity while expanding operations. A Chase small business auto loan solves this by spreading the vehicle cost over several years, allowing businesses to grow without financial strain.

It also ensures operational continuity. Companies that rely on transportation for sales, delivery, or services can’t afford vehicle downtime. A loan enables them to upgrade vehicles quickly and keep operations moving.

How to Apply and Where to Buy

Here are your next steps to apply for a Chase business auto loan:

- Apply Online at Chase

- Check Prequalification at SmartBiz

- Compare at LendingTree

- Review Credit Options at Nav

- See Rates at Bank of America

FAQs

What credit score is needed for a Chase small business auto loan? Chase typically requires good credit, often a score of 680 or higher. However, your business history and relationship with the bank may influence approval.

Can I finance multiple vehicles with one application? Yes, Chase allows businesses to finance multiple vehicles under one commercial loan, depending on your creditworthiness and business needs.

Are there penalties for early repayment? Chase usually does not charge prepayment penalties on small business auto loans, but confirm this with your loan officer to be sure.