Discount Auto Insurance Quotes – Compare & Save in 2025

Discount auto insurance quotes refer to reduced premium rates offered by insurance companies based on various qualifying factors. These discounts can significantly lower your insurance costs, making it essential to understand how they work and how to qualify for them.

Factors Influencing Auto Insurance Discounts

Several factors can affect your eligibility for auto insurance discounts:

- Driving Record: A clean driving history often qualifies for safe driver discounts.Allstate+11Investopedia+11ValuePenguin+11

- Vehicle Safety Features: Cars equipped with advanced safety features may be eligible for discounts.

- Bundling Policies: Combining auto insurance with other policies like home insurance can lead to multi-policy discounts.

- Payment Methods: Opting for automatic payments or paying the full premium upfront can result in savings.

- Memberships and Affiliations: Being part of certain organizations or professions may qualify you for specific discounts.An Insurance Company You Can Rely On+3Liberty Mutual+3Kiplinger+3

Top Providers Offering Discount Auto Insurance Quotes

GEICO

GEICO offers a variety of discounts, including those for good drivers, military personnel, federal employees, and students. Their user-friendly online platform allows for easy quote comparisons and policy management.ValuePenguin+1Root® Insurance+1

Liberty Mutual

Liberty Mutual provides numerous discounts, such as multi-policy, multi-car, and safe driver discounts. Their RightTrack® program rewards drivers for safe driving habits by offering additional savings.

Progressive

Progressive’s Snapshot® program personalizes rates based on your driving behavior. They also offer discounts for bundling policies, signing up online, and being a homeowner.An Insurance Company You Can Rely On

Allstate

Allstate rewards safe drivers through their Drivewise® program, which monitors driving habits to offer personalized discounts. They also provide savings for students, new cars, and policy bundling.Allstate+3Allstate+3Zebra Insurance Quotes+3

The General

The General specializes in providing affordable insurance options for high-risk drivers. They offer quick online quotes and flexible payment plans to accommodate various financial situations.The General Car Insurance

Benefits of Using Technology to Find Discounts

Modern technology has revolutionized the way we shop for auto insurance. Online comparison tools and mobile apps allow you to:

- Compare Multiple Quotes: Quickly view and compare rates from various insurers.

- Customize Coverage: Adjust coverage options to see how they affect your premium.An Insurance Company You Can Rely On

- Access Exclusive Discounts: Some online platforms offer special discounts not available elsewhere.

- Manage Policies: Easily update information, file claims, and make payments through digital platforms.Liberty Mutual+23The General Car Insurance+23Zebra Insurance Quotes+23

Real-World Examples of Discount Auto Insurance Tools

The Zebra

The Zebra is an online marketplace that allows users to compare quotes from over 100 insurance providers. By entering basic information, you can receive personalized quotes and find the best rates for your needs.Zebra Insurance Quotes+1Kiplinger+1Zebra Insurance Quotes

Insurify

Insurify uses artificial intelligence to match drivers with optimal insurance policies. Their platform provides real-time quotes and highlights available discounts based on your profile.Wikipedia

NerdWallet

NerdWallet offers a comprehensive comparison tool that evaluates coverage options, discounts, and customer reviews. Their resources help users make informed decisions when selecting an insurance provider.

Gabi

Gabi automates the process of comparing your current policy with other available options. By analyzing your existing coverage, Gabi identifies potential savings and facilitates easy policy switching.gabi.com

Experian

Experian’s auto insurance comparison tool allows users to compare rates from multiple insurers. Their platform provides insights into credit-based insurance scores and how they impact premiums.

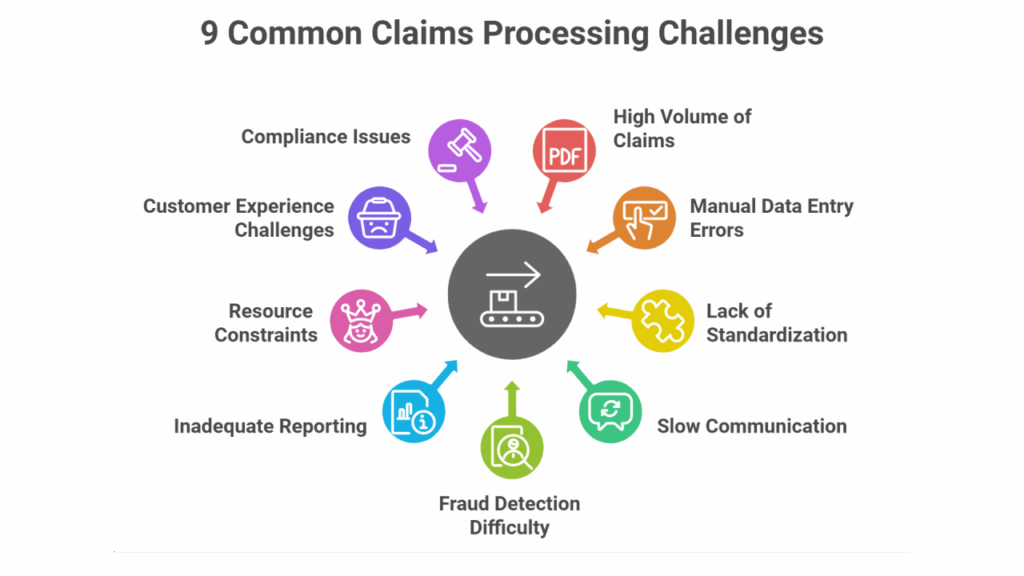

Use Cases: Solving Common Insurance Challenges

Scenario 1: New Driver Seeking Affordable Coverage

A newly licensed driver is looking for cost-effective insurance options. By using comparison tools like The Zebra or Insurify, they can identify providers offering discounts for new drivers or students, ensuring they find a policy that fits their budget.

Scenario 2: Experienced Driver with a Clean Record

An experienced driver with a spotless driving history wants to capitalize on safe driver discounts. Programs like Progressive’s Snapshot® or Allstate’s Drivewise® monitor driving habits and reward safe behavior with lower premiums.Zebra Insurance Quotes+2NerdWallet: Finance smarter+2ValuePenguin+2Zebra Insurance Quotes

Scenario 3: Homeowner Looking to Bundle Policies

A homeowner aims to consolidate their insurance policies for convenience and savings. By bundling home and auto insurance with providers like Liberty Mutual or GEICO, they can benefit from multi-policy discounts and streamlined policy management.

How to Obtain Discount Auto Insurance Quotes

Securing discounted auto insurance quotes involves a few strategic steps:

- Gather Information: Have your personal details, vehicle information, and current insurance policy ready.

- Use Comparison Tools: Utilize platforms like The Zebra, Insurify, or NerdWallet to compare quotes from multiple providers.

- Identify Discounts: Look for available discounts based on your profile, such as safe driver, multi-policy, or student discounts.

- Evaluate Coverage: Ensure the policies you’re considering provide adequate coverage for your needs.

- Purchase Policy: Once you’ve selected the best option, complete the purchase online or through an agent.

Frequently Asked Questions

Q1: How often should I shop for auto insurance quotes?

A1: It’s advisable to compare auto insurance quotes at least once a year or whenever significant life changes occur, such as moving, buying a new car, or experiencing changes in your driving record.

Q2: Will shopping for quotes affect my credit score?