Get a Car Finance Quote – Compare Top Lenders Instantly Online

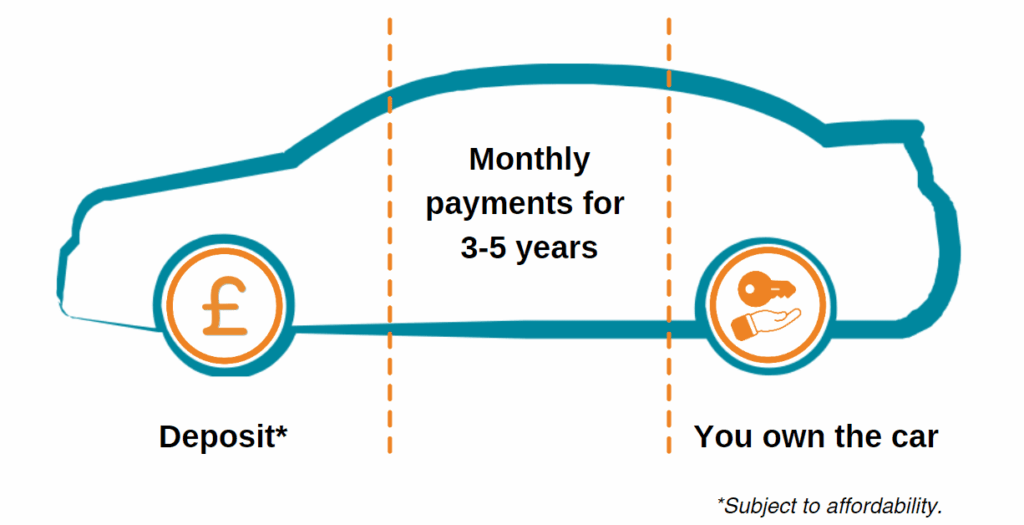

A car finance quote is a personalized estimate of how much it will cost to finance a vehicle. It includes details such as loan amount, interest rate, term length, and monthly repayments. Getting a quote allows buyers to plan their budget, compare lenders, and make informed decisions without committing to a hard credit check upfront.

Online quotes are often instant and use soft credit pulls or income-based estimations. This convenience has revolutionized car financing by putting more control into the hands of consumers.

How Getting a Car Finance Quote Works

When you request a quote, lenders use financial data like your income, employment, and credit profile to generate an offer. Some platforms aggregate multiple quotes, giving you a clear view of your options.

Most quotes are valid for 14 to 30 days and can be adjusted based on the specific car or down payment. You are under no obligation to proceed unless you choose to apply formally.

Benefits of Comparing Car Finance Quotes

Comparing car finance quotes helps you avoid overpaying on interest or fees. Even a 1% rate difference can save hundreds or thousands over a loan term. Quotes also help buyers with varying credit profiles find deals they actually qualify for.

Many platforms also show potential offers with and without down payments, helping buyers plan their ideal loan structure. Transparency in terms means fewer surprises during final approval.

Technology Behind Online Car Finance Tools

Modern platforms use APIs to instantly pull credit and financial data. These integrations allow them to show pre-qualified offers in real time, often with AI matching lenders to the user’s risk profile.

Mobile apps and online dashboards make it easy to compare, track, and save quotes. Many tools also integrate with dealership websites, creating a seamless experience from quote to approval.

Insert image of the product [CarFinance 247 Quote Tool]

CarFinance 247 offers real-time quotes with soft credit checks, personalized loan matches, and a UK-wide lender network. It’s ideal for buyers looking for fast decisions and flexible terms.

Use Case: Perfect for customers with diverse credit profiles who want to explore financing without impacting their score.

Insert image of the product [AutoPay Quote Finder]

AutoPay provides pre-qualified quotes within seconds and allows you to adjust loan terms and down payment in real time. It also offers direct-to-dealer delivery of your financing.

Use Case: Ideal for new car buyers wanting seamless integration with dealerships and quick approvals.

Insert image of the product [Driva Australia Car Loan Quotes]

Driva is an Australian platform offering tailored car finance quotes from over 30 lenders. Their technology cross-checks your credit profile for the best-matched options.

Use Case: Excellent for buyers in Australia who want multiple quotes without manual applications.

Insert image of the product [RateGenius Refinance Quote Tool]

RateGenius specializes in refinancing but also offers fresh car loan quotes. You enter minimal details and receive multiple lender matches.

Use Case: Great for current car owners looking to refinance or upgrade vehicles with better loan terms.

Insert image of the product [Capital One Auto Navigator]

Capital One Auto Navigator gives real-time finance quotes with no hard credit pull. You can shop cars and financing together, then adjust terms based on your preferences.

Use Case: Ideal for buyers who want to browse inventory and pre-qualify for financing in one session.

How These Platforms Solve Real Buyer Problems

A buyer with limited credit wants to purchase a reliable used car. Using CarFinance 247, they compare several quotes and choose one with a manageable rate and no upfront fee. They avoid dealership markups and save over £1,000.

Another user needs fast financing for a car located in another state. AutoPay provides instant pre-approval and coordinates directly with the dealer. The user drives away the next day without visiting a bank.

How to Get a Car Finance Quote and Next Steps

The process is simple: visit a trusted platform, enter your basic financial info, and receive quotes instantly. If you like an offer, you can proceed to full application.

- Get a Quote from CarFinance 247

- Compare with AutoPay

- Get Your Driva Quote

- Try RateGenius

- Start with Capital One

FAQs

Will getting a quote hurt my credit score? Most platforms use soft credit checks, so your score is not impacted unless you apply formally.

Can I negotiate a car price after getting a finance quote? Yes, your quote is for financing. You can still negotiate the car’s sale price separately.

What’s the best time to get a finance quote? Before visiting a dealership—this gives you leverage and prevents being locked into dealer financing.