Shop Home and Auto Insurance Bundles – Save Big in 2025

Bundling home and auto insurance policies can lead to significant savings and convenience. By purchasing both policies from the same insurer, you may qualify for discounts and simplify your insurance management.

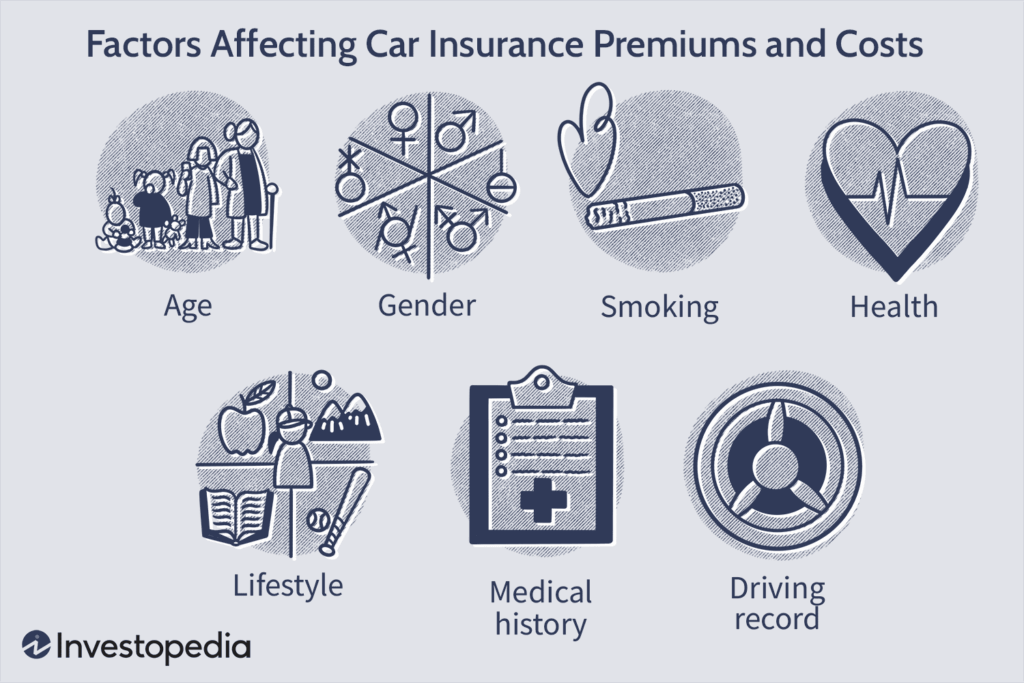

Factors Influencing Insurance Rates

Several elements can impact the cost of your home and auto insurance:Farmers Insurance+7AAA+7Insurance.com+7

- Location: Urban areas may have higher rates due to increased risks.

- Vehicle Type: Certain cars are more expensive to insure based on repair costs and safety ratings.

- Home Characteristics: The age, construction, and safety features of your home can affect premiums.

- Credit Score: Insurers often use credit scores to determine rates.

- Coverage Levels: Higher coverage limits and lower deductibles generally lead to higher premiums.

Benefits of Bundling Home and Auto Insurance

Combining your home and auto insurance policies offers several advantages:Allstate+1SelectQuote Life+1

- Cost Savings: Many insurers offer discounts for bundled policies.Forbes+5U.S. News+5An Insurance Company You Can Rely On+5

- Simplified Management: Having both policies with one insurer means one bill and one point of contact.

- Enhanced Coverage Options: Some insurers provide additional benefits for bundled policies.

How to Compare Home and Auto Insurance Bundles

Gather Necessary Information

Before comparing bundles, collect the following details:

- Personal Information: Name, address, and contact details.

- Vehicle Information: Make, model, year, and VIN.

- Home Information: Address, construction details, and safety features.

- Current Coverage: Details of your existing policies.Zebra Insurance Quotes+4Insure.com+4Insurance.com+4

Use Online Comparison Tools

Several online platforms allow you to compare bundled insurance quotes:

- The Zebra: Offers side-by-side comparisons from over 100 providers.

- NerdWallet: Provides personalized rate estimates and insurer reviews.

- Policygenius: Simplifies the insurance shopping process by offering side-by-side comparisons of policies.

- Matic: Allows users to compare quotes from multiple insurers quickly and efficiently.

- Insurify: Automates the comparison process by analyzing your current policy and finding better rates from other insurers.

Advantages of Using Comparison Tools

Utilizing these tools offers several benefits:

- Time Efficiency: Quickly receive multiple quotes without contacting each insurer individually.

- Cost Savings: Identify more affordable policies that meet your coverage needs.

- Transparency: Easily compare coverage options and understand policy details.

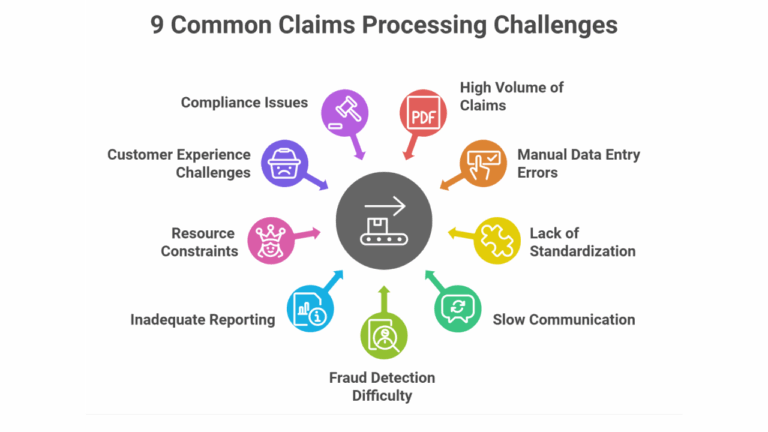

Use Cases: Solving Common Insurance Challenges

Scenario 1: New Homeowner

A first-time homebuyer needs both home and auto insurance. Bundling policies simplifies the process and provides cost savings.U.S. News+5An Insurance Company You Can Rely On+5Reddit+5NerdWallet: Finance smarter+6U.S. News+6Allstate+6

Scenario 2: Policy Renewal

An existing policyholder notices a significant premium increase upon renewal. Shopping around for bundled policies can lead to better rates.Forbes+1Bankrate+1

Scenario 3: Life Changes

After moving to a new state, a driver needs to adjust their coverage. Comparison tools help them navigate different state requirements and select appropriate bundled policies.

How to Purchase Bundled Insurance

Once you’ve compared quotes and selected a bundle, you can purchase insurance through the following methods:

- Online: Most insurers offer online applications and instant policy issuance.

- Phone: Call the insurer directly to speak with an agent and complete the purchase.ValuePenguin+4Insure.com+4Farmers Insurance+4

- In-Person: Visit a local agent’s office to discuss options and finalize the policy.

Frequently Asked Questions

Q1: How often should I shop for bundled insurance?

A1: It’s recommended to compare bundled insurance rates at least once a year or whenever you experience a significant life change, such as moving, buying a new car, or getting married.

Q2: Will shopping for bundled insurance affect my credit score?

A2: No, obtaining insurance quotes typically involves a soft credit check, which does not impact your credit score.

Q3: Can I switch insurance providers mid-policy?

A3: Yes, you can switch providers at any time, but it’s essential to ensure there’s no lapse in coverage during the transition.